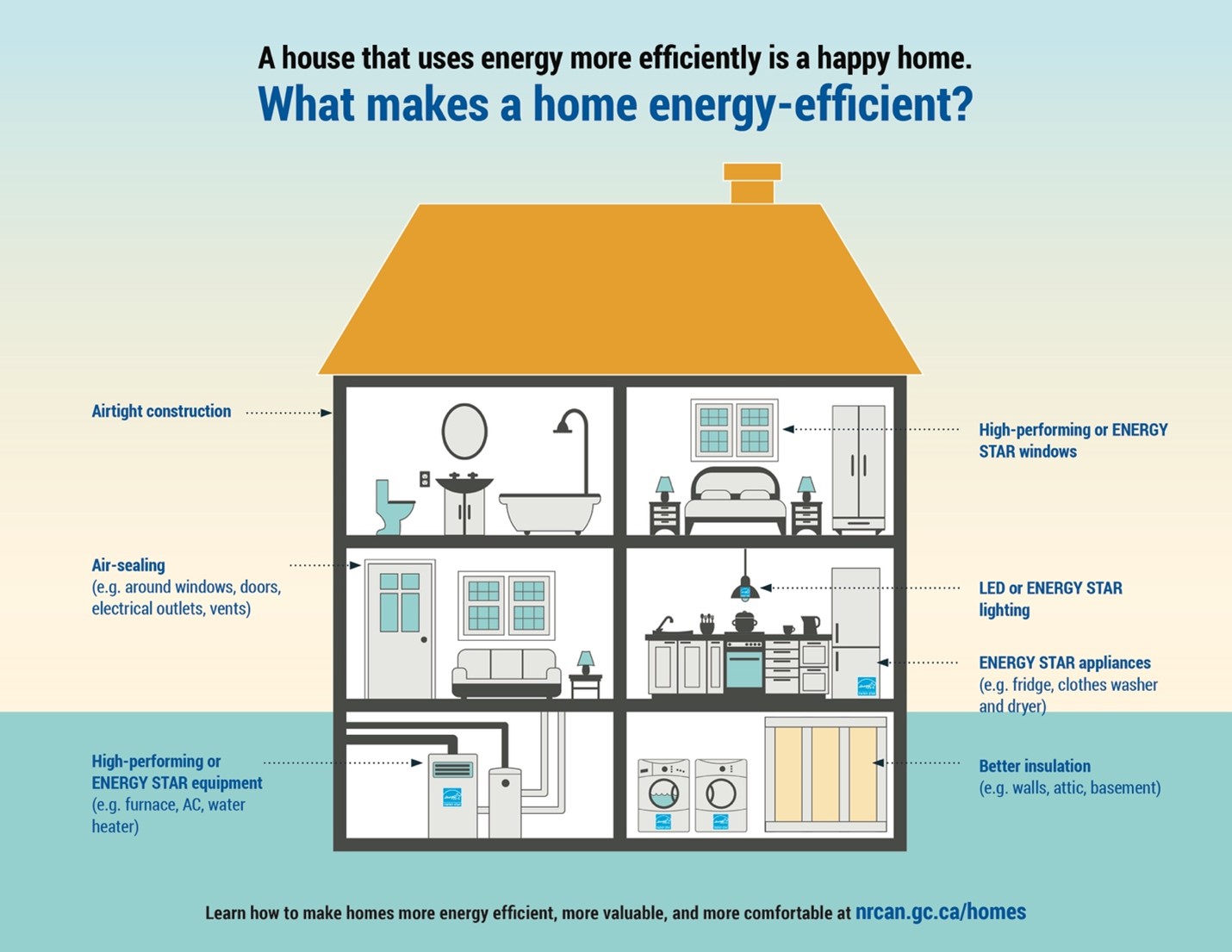

What Home Energy Improvements Are Tax Deductible To qualify for the credit certain property must meet certain energy efficiency requirements Exterior windows and skylights must meet Energy Star most efficient certification requirements For more information see the Energy Star Windows Skylights Tax Credit webpage Exterior doors must meet applicable Energy Star requirements

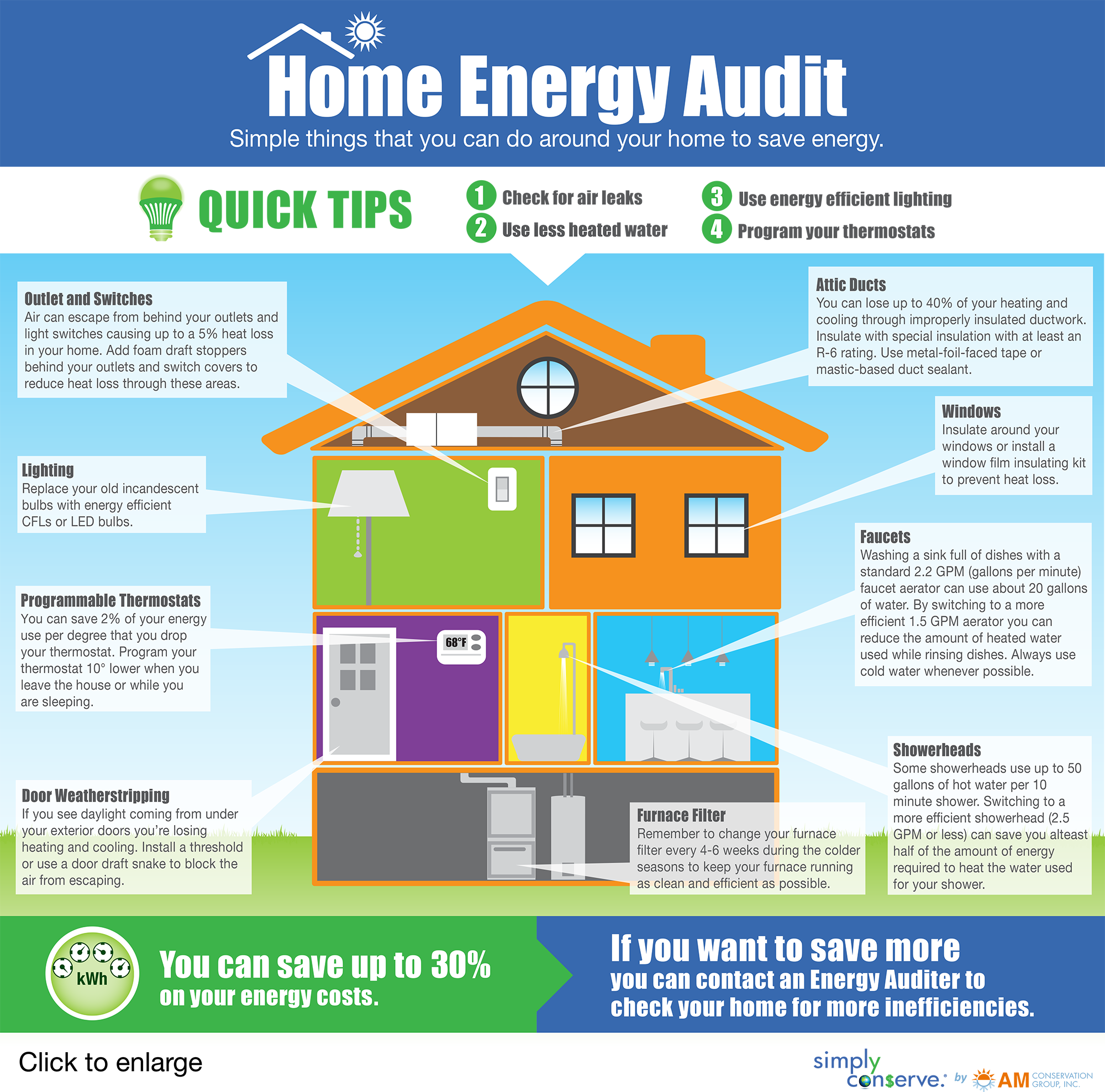

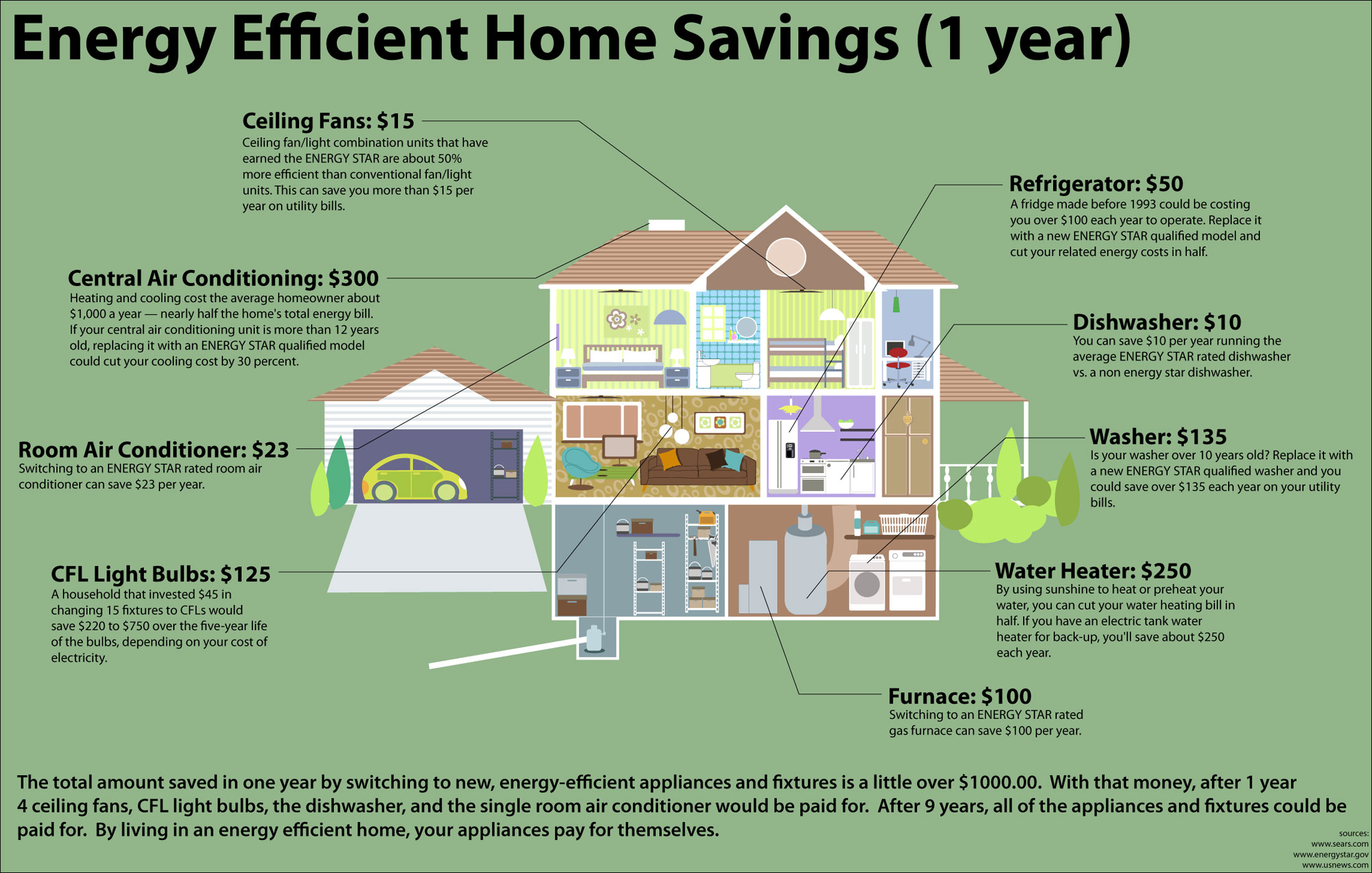

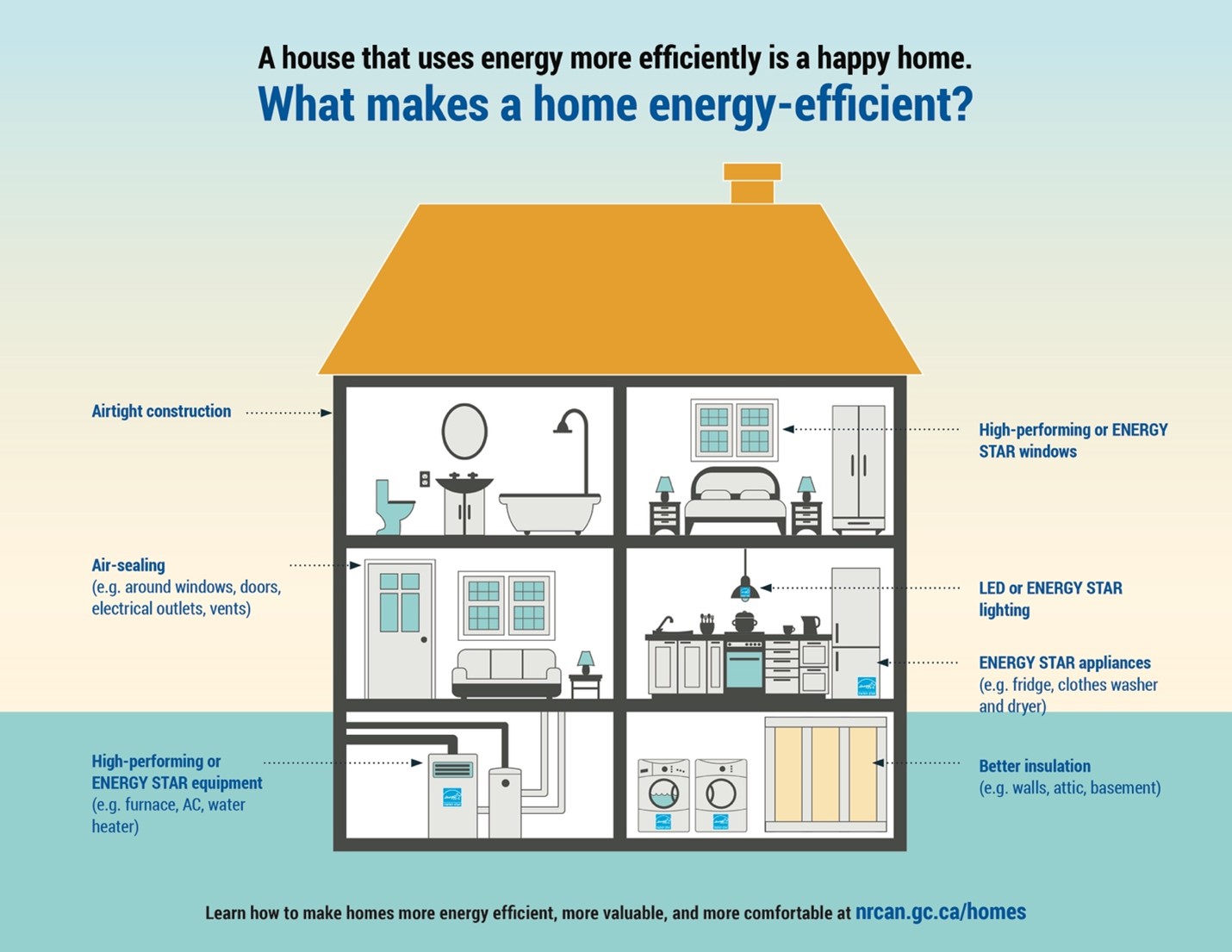

Here are eight ways you can claim a tax deduction or tax credit for home improvements Energy Efficient Improvements The federal government offers tax credits for specific energy efficient home improvements such as the installation of energy efficient windows doors roofing insulation and certain heating and cooling equipment According to the IRS improvements that add to the value of your home prolong its useful life or adapt it to new uses may reduce your capital gains tax

What Home Energy Improvements Are Tax Deductible

What Home Energy Improvements Are Tax Deductible

https://i.ytimg.com/vi/6T3kvwk4Mtw/maxresdefault.jpg

SSF Logo 2

https://i0.wp.com/steppingstoneskeller.org/wp-content/uploads/2023/01/cropped-SSF-Logo-2.png?resize=1536%2C903&ssl=1

Bryce Shirt Downtown Boxing Gym

https://dbgdetroit.org/wp-content/uploads/2023/03/Bryce-Shirt.jpg

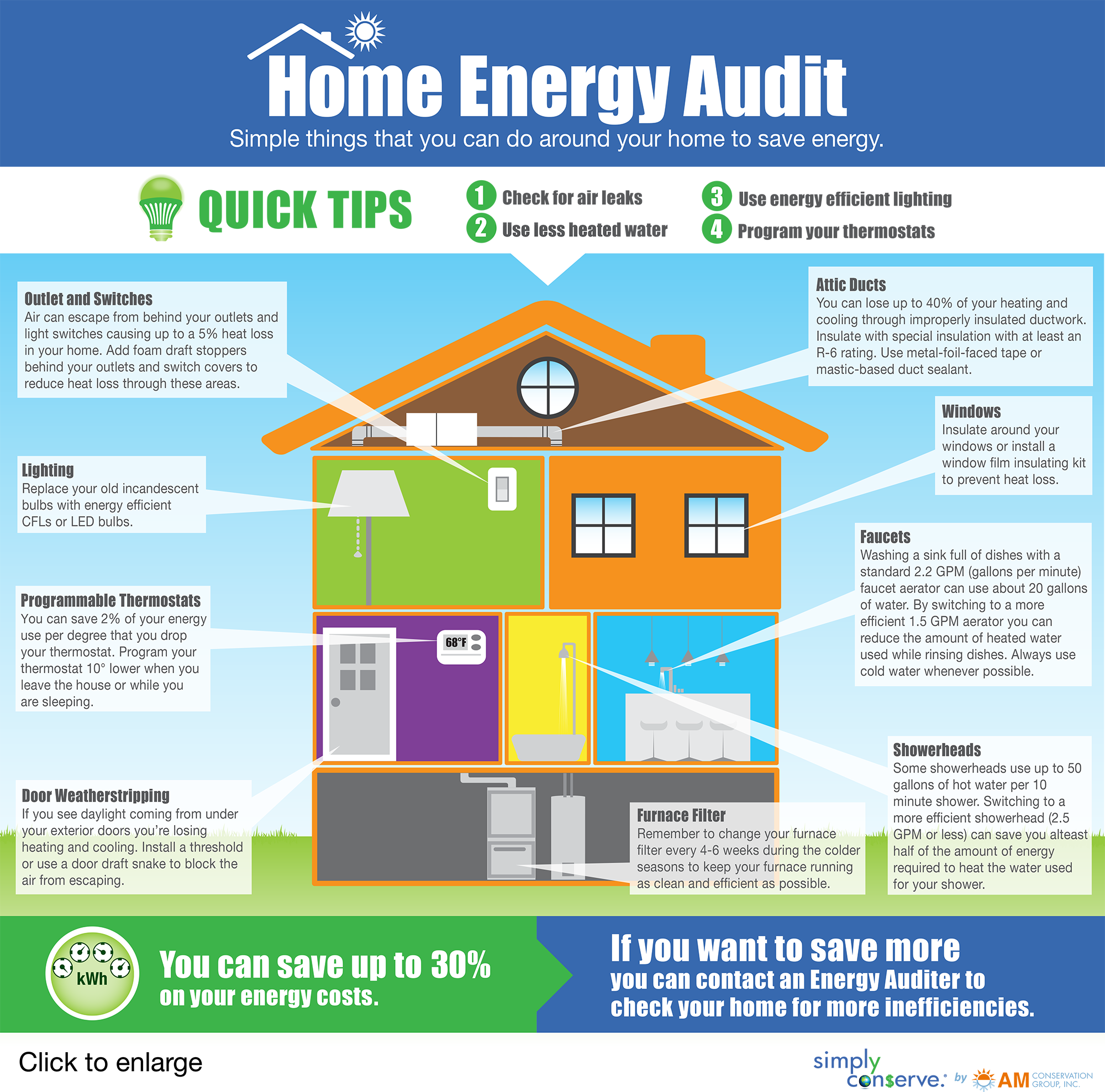

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022 You may qualify for energy tax credits if you made renewable energy upgrades or energy efficient improvements to your home like solar or geothermal equipment Learn more about the Energy Efficient Home Improvement Credit and the Residential Clean Energy Credit and find out whether you re eligible to claim these write offs to save on your taxes

For homeowners these credits represent a significant opportunity to invest in long term energy savings while improving the comfort of your home and reducing your tax burden By understanding the new requirements you can make informed decisions that make sense for your wallet and your home Homeowners can potentially qualify for an Energy Efficiency Home Improvement Credit of up to 3 200 for energy efficient improvements made after Jan 1 2023 The credit for 2024 is 30 of qualified expenses but it has certain limits depending on the type of improvement

More picture related to What Home Energy Improvements Are Tax Deductible

Thanks Hadessa Calaveras Humane Society

https://calaverashumane.org/wp-content/uploads/2022/08/396DE03E-84EF-4FC1-87B5-A840B1D6A482.jpeg

![]()

Nevada Renewable Energy Program NV Renew

https://sp-ao.shortpixel.ai/client/to_webp,q_glossy,ret_img,w_800,h_401/https://nvrenew.com/wp-content/uploads/2023/09/Tax_deductable-1024x513.jpg

Landscaping And Home Energy Improvements

http://www.house-energy.com/images/d74.jpg

Home improvements are tax deductible if they meet the three qualifying criteria Energy efficient home improvements like replacing leaky doors and windows equipping your home with Certain improvements particularly those that increase the energy efficiency of a home might qualify for federal tax credits Claiming these credits can offer some financial relief reducing the overall tax burden by a set amount

[desc-10] [desc-11]

Home Energy Improvements Heating Cooling

http://www.aee-inc.com/images/home-energy-audit-lg.png

Daily Savings Expert Tips For Saving Money WorkMoney

https://workmoney.org/sites/default/files/styles/your_good_life_image_highlight/public/2023-08/what energy efficient improvements are tax deductible.jpg?itok=E5RaEsNN

https://www.irs.gov › credits-deductions › frequently...

To qualify for the credit certain property must meet certain energy efficiency requirements Exterior windows and skylights must meet Energy Star most efficient certification requirements For more information see the Energy Star Windows Skylights Tax Credit webpage Exterior doors must meet applicable Energy Star requirements

https://americantaxservice.org › home-improvements-a

Here are eight ways you can claim a tax deduction or tax credit for home improvements Energy Efficient Improvements The federal government offers tax credits for specific energy efficient home improvements such as the installation of energy efficient windows doors roofing insulation and certain heating and cooling equipment

Teamwork Makes The Dream Work Calaveras Humane Society

Home Energy Improvements Heating Cooling

Blog Carbon Valley Home Services Firestone Frederick Etc Handyman

Tax Deductible Home Improvements Tax Deductions Home Improvement

Tax Deductible Home Improvements 2024 Pearl Beverlie

Building An Energy Efficient Home Signature Homes

Building An Energy Efficient Home Signature Homes

Donation Letter For Taxes Sample And Examples Word

Real Estate Tax Deduction Sheet

7 Home Improvement Tax Deductions INFOGRAPHIC Tax Deductions

What Home Energy Improvements Are Tax Deductible - [desc-13]