What Is A 401 K Plan And How Does It Work What Is A 401 k How Does It Work A 401 k is an employer sponsored retirement savings plan Commonly offered as part of a job benefits package employees may save a portion of

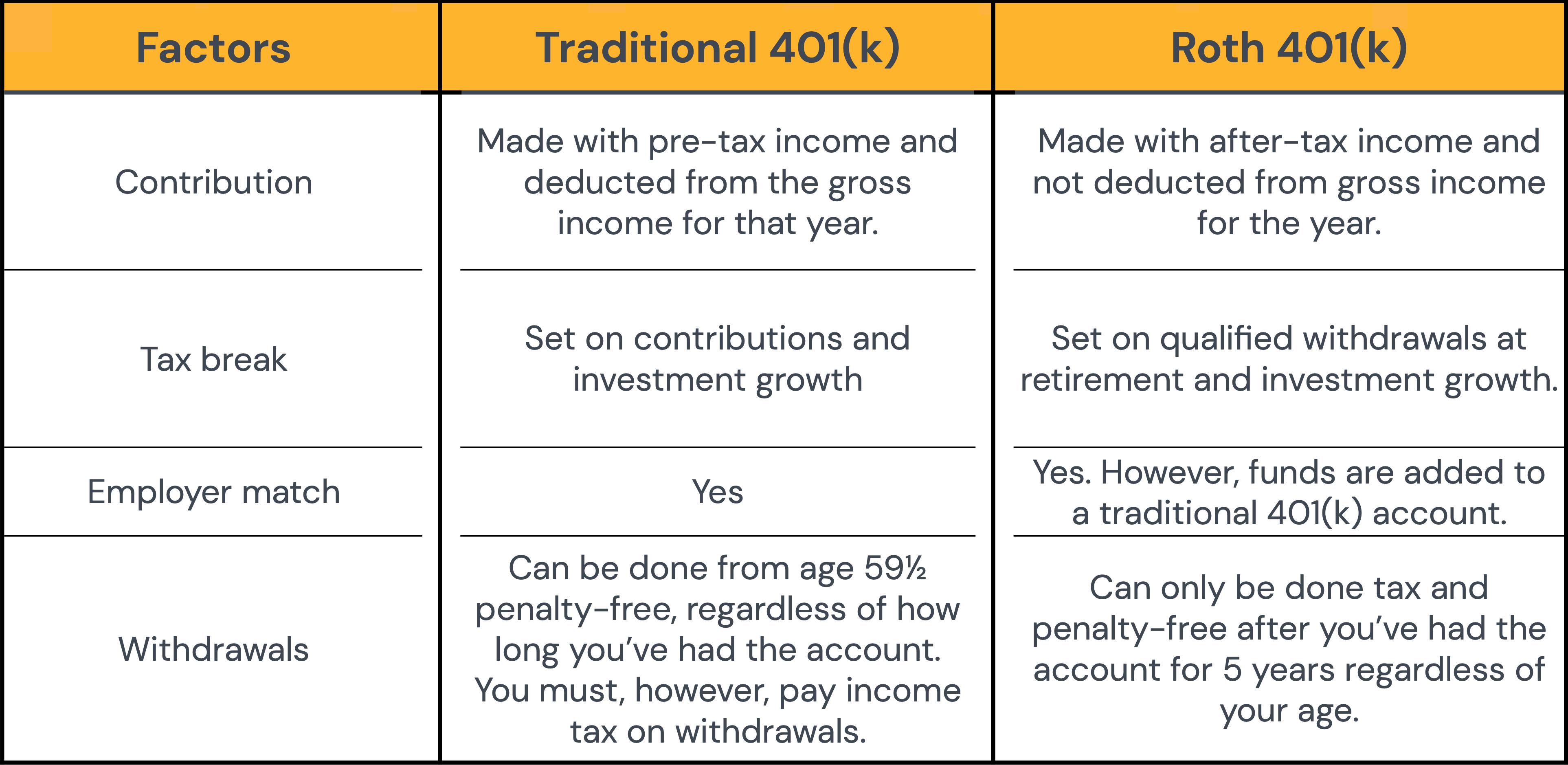

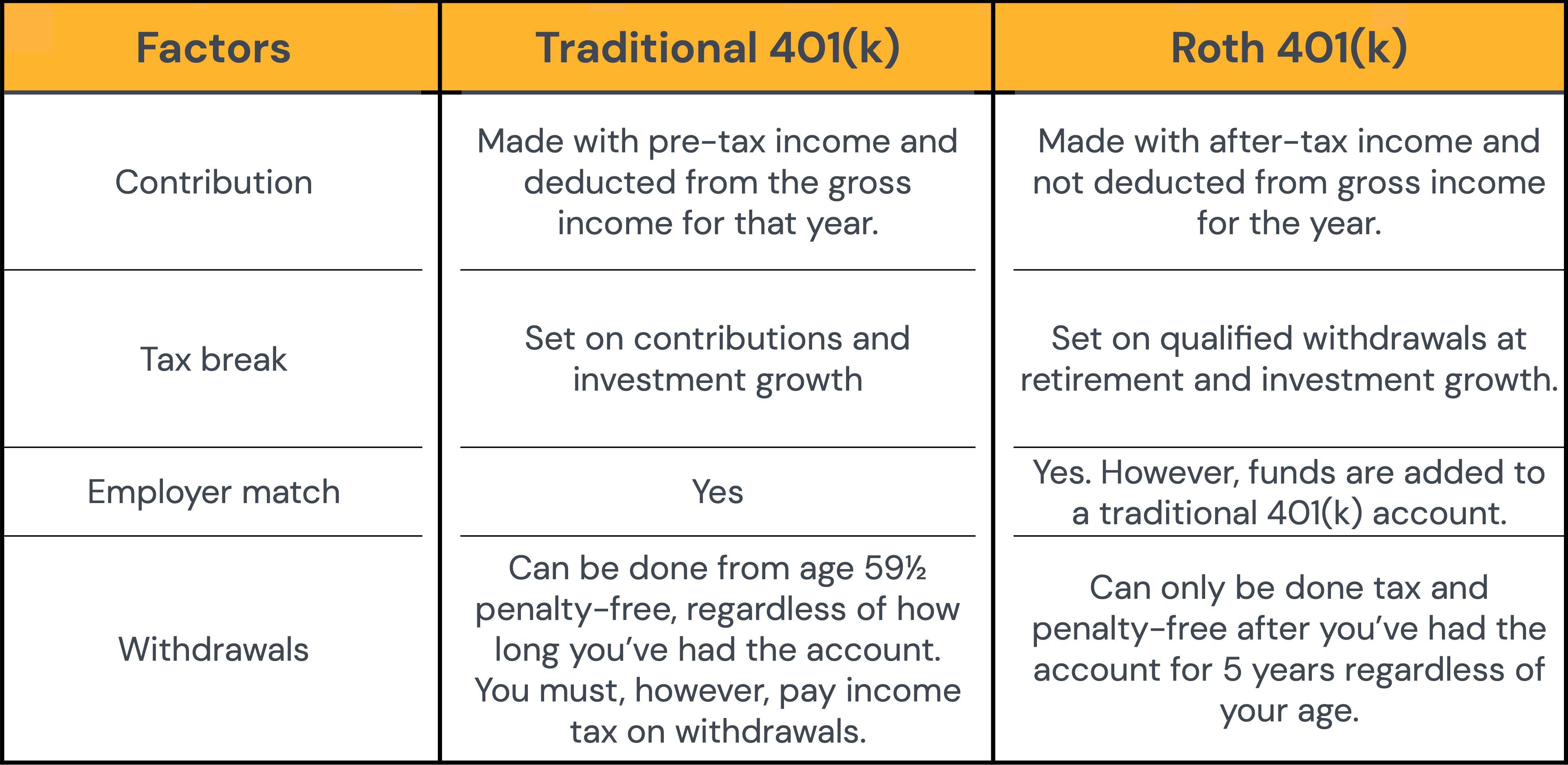

What Is a 401 k and How Do They Work 401 k contributions are usually pre tax reducing taxable income and allowing tax deferred growth though many employers offer after tax Roth 401 k s How Does the 401 k Work A 401 k plan usually consists of three components employee deferrals employer contributions and investment options Under a traditional 401 k employees choose how much to contribute from their paychecks each month

What Is A 401 K Plan And How Does It Work

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png)

What Is A 401 K Plan And How Does It Work

https://www.investopedia.com/thmb/9Rj4BAvEf2P_WLFphJolmALSRUw=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png

Mercer 401k 79

https://images.prismic.io/pigeon-loans/64616ccf-d93d-4d39-aa9d-68dc50f89c47_401ks2.png?auto=compress,format

Roth 401 K

https://m.foolcdn.com/media/dubs/images/roth-401k-vs-roth-ira-retirement-plans-infogra.width-880.png

A 401 k is an employer sponsored retirement plan that comes with tax benefits Basically you put money into the 401 k where it can be invested and potentially grow tax free over time In most cases you choose how much money you want to contribute to your 401 k based on a percentage of your income With a basic 401 k plan employees contribute a portion of their pre tax wages into a retirement account Their employer may match their contribution either fully or

A 401 k is a staple for many people s retirement planning so it s important to understand how they work Browse Investopedia s expert written library to learn more How does a 401 k work 401 k s are defined contribution plans This means that employers create a retirement plan which allows employees to contribute money otherwise known as a deferral on a pre tax basis up to a limit set by the IRS

More picture related to What Is A 401 K Plan And How Does It Work

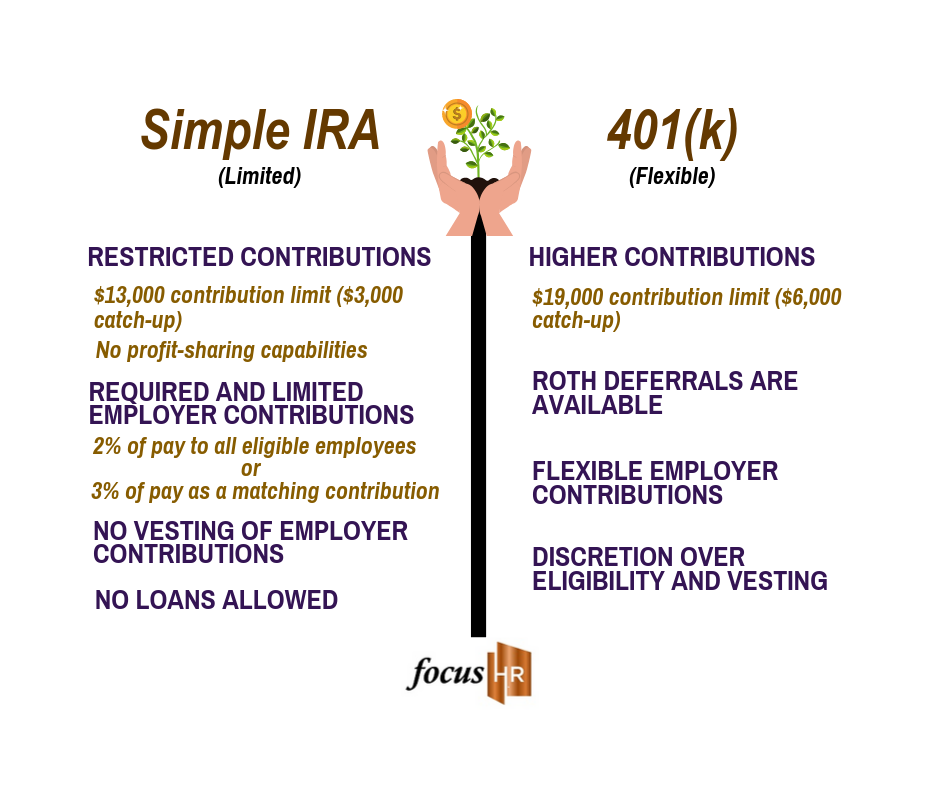

Fidelity Simple Ira Contribution Limits 2025 Frank M Cooper

https://focushr.net/wp-content/uploads/2019/09/Simple-IRA.png

:max_bytes(150000):strip_icc()/401k-retirement-plan-beginners-357115_FINAL2-430f125e634544fe80440a1cf026eafe.png)

Retirement Plan 401k

https://www.thebalancemoney.com/thmb/Zk5vHtGLbBP1-iwLMiDVgM_ZAWs=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/401k-retirement-plan-beginners-357115_FINAL2-430f125e634544fe80440a1cf026eafe.png

401k Employer Match Limit 2024 Luise Robinia

https://sheetsforinvestors.com/wp-content/uploads/2021/06/401k-employer-matching.jpg

What is a 401 k plan and how does it work A 401 k plan is a tax advantaged retirement savings tool offered by employers that allows eligible employees to contribute a portion of A 401 k plan is a tax advantaged retirement investment account that companies often offer to their workers It s also what s called a defined contribution plan because employees set aside or contribute a percentage of their paychecks to their 401 k s

[desc-10] [desc-11]

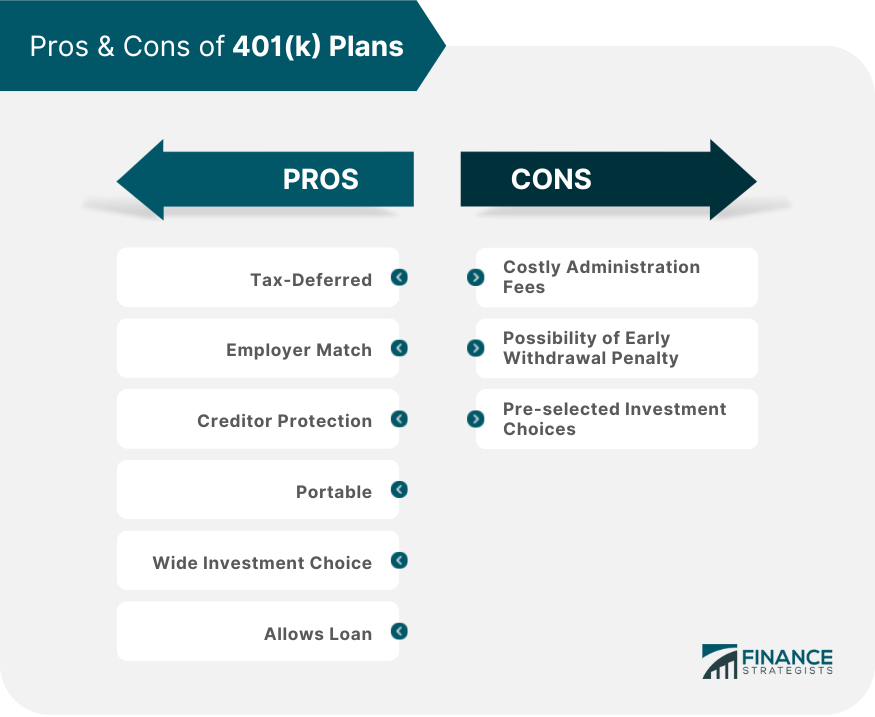

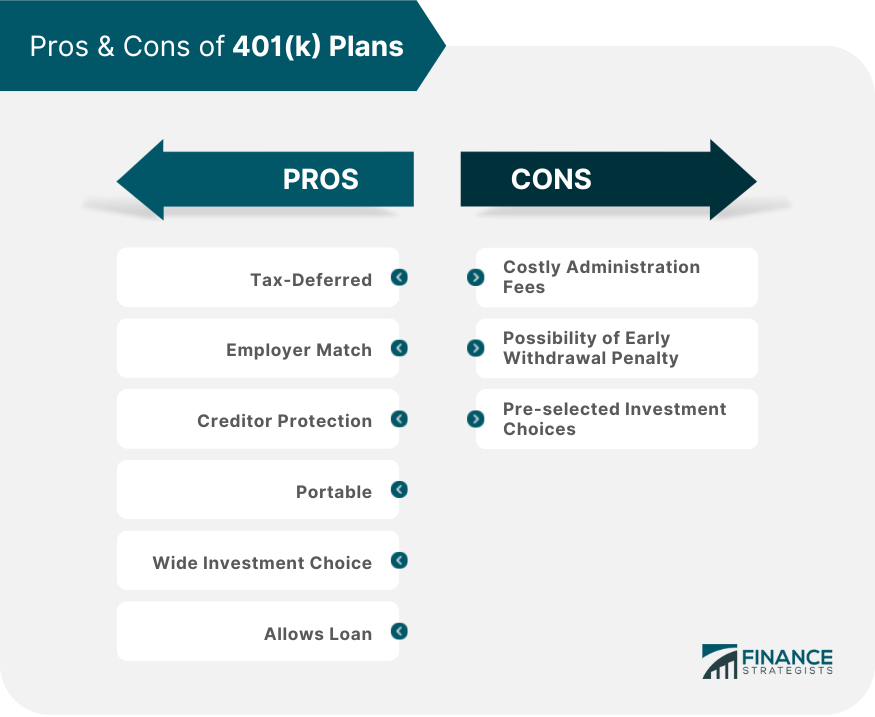

401 K Max For 2025 Ginni Yolande

https://www.financestrategists.com/uploads/Pros-Cons-of-401k-Plans.png

401 K Max For 2025 Ginni Yolande

https://learn.financestrategists.com/wp-content/uploads/Traditional_401k_Plan.png

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png?w=186)

https://www.forbes.com › advisor › retirement

What Is A 401 k How Does It Work A 401 k is an employer sponsored retirement savings plan Commonly offered as part of a job benefits package employees may save a portion of

https://www.fool.com › retirement › plans

What Is a 401 k and How Do They Work 401 k contributions are usually pre tax reducing taxable income and allowing tax deferred growth though many employers offer after tax Roth 401 k s

401k Limit 2025 Roth Walter S Barlow

401 K Max For 2025 Ginni Yolande

401k 2024 Morna Tiertza

matching example_ Boeing.png?width=3720&name=401(k) matching example_ Boeing.png)

Average 401k Match 2025 Francis N Fish

401k Limits 2025 Married Shahram Dylan

Roth Contribution Limits 2025 And Magi Bita Tessa

Roth Contribution Limits 2025 And Magi Bita Tessa

Current 401k Contribution Limits 2024 Employer Match Bell Marika

401 k Plan Definition How It Works Types Features

2025 Pre Tax 401k Limit Darya Emelyne

What Is A 401 K Plan And How Does It Work - [desc-12]