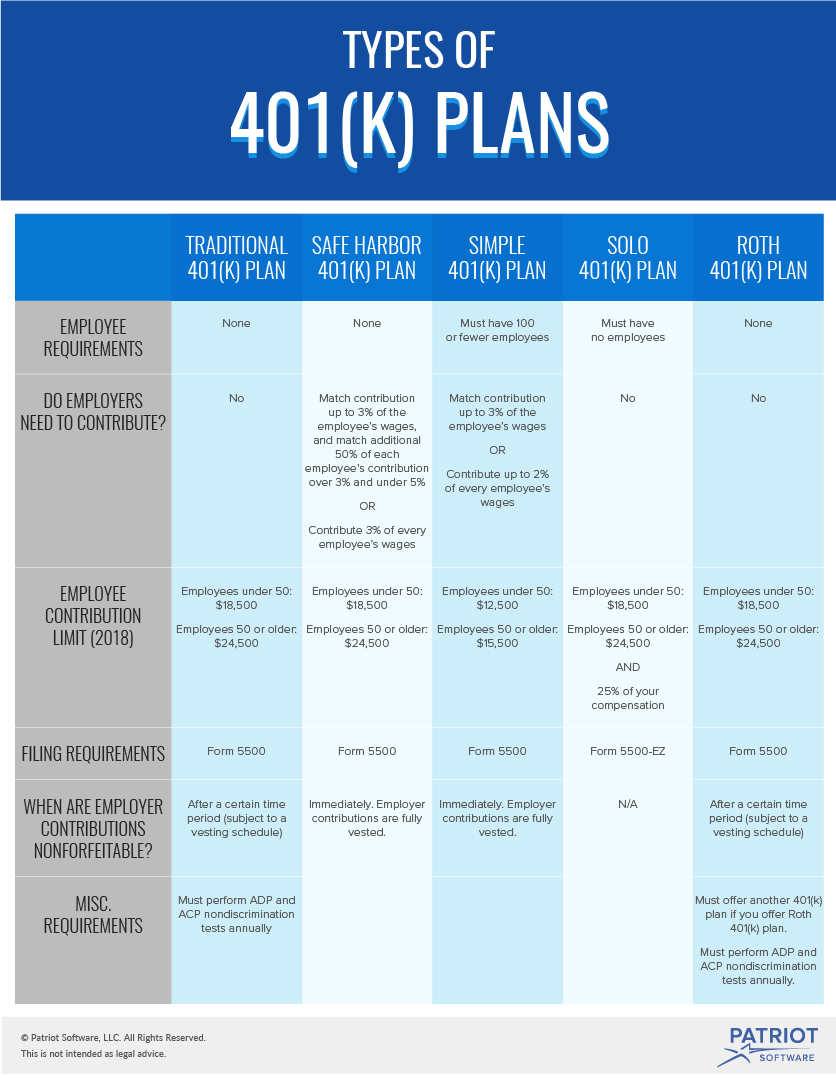

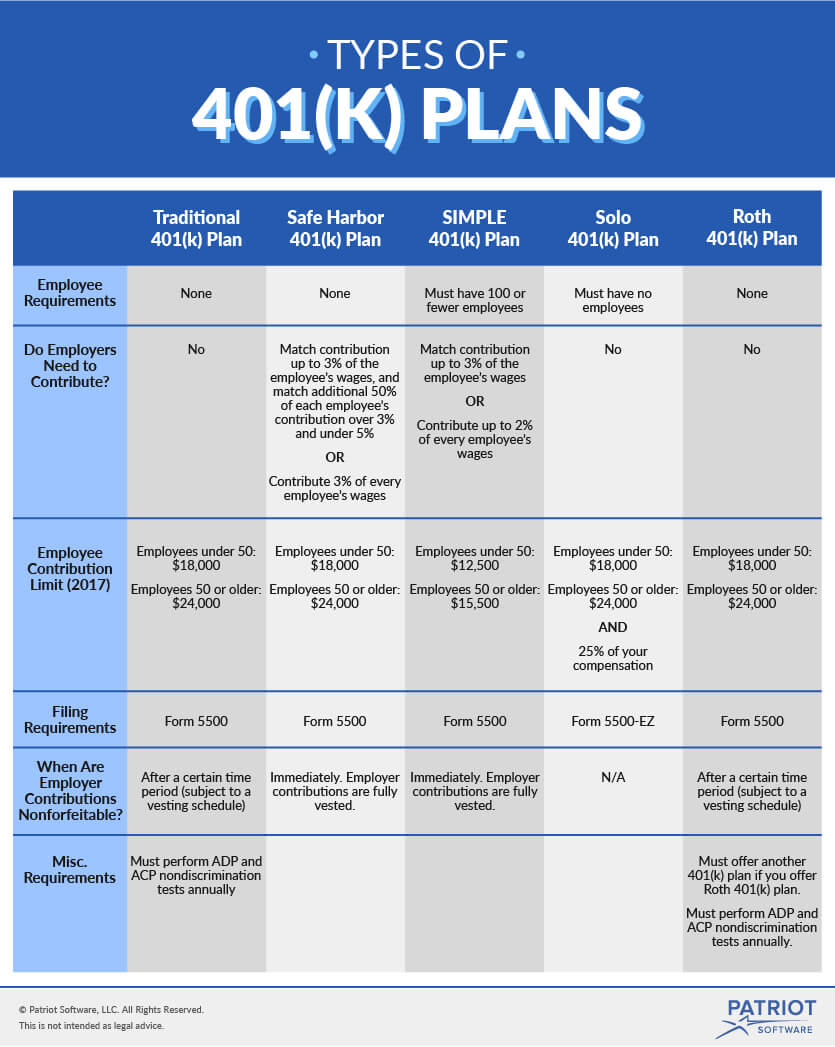

What Is A Simple 401 K Plan Under a SIMPLE 401 k plan an employee can elect to defer some compensation But unlike a regular 401 k plan you the employer must make either A non

For example instead of a traditional 401 k plan a small business owner can opt for a SIMPLE 401 k They sound similar but there are important differences between them that SIMPLE 401 k SIMPLE IRA and traditional 401 k plans provide employers of different sizes and growth trajectories with a plan that fits their goals Let s review the benefits and drawbacks of each

What Is A Simple 401 K Plan

What Is A Simple 401 K Plan

http://www.ogr.org/assets/images/2016 access 401k chart.jpg

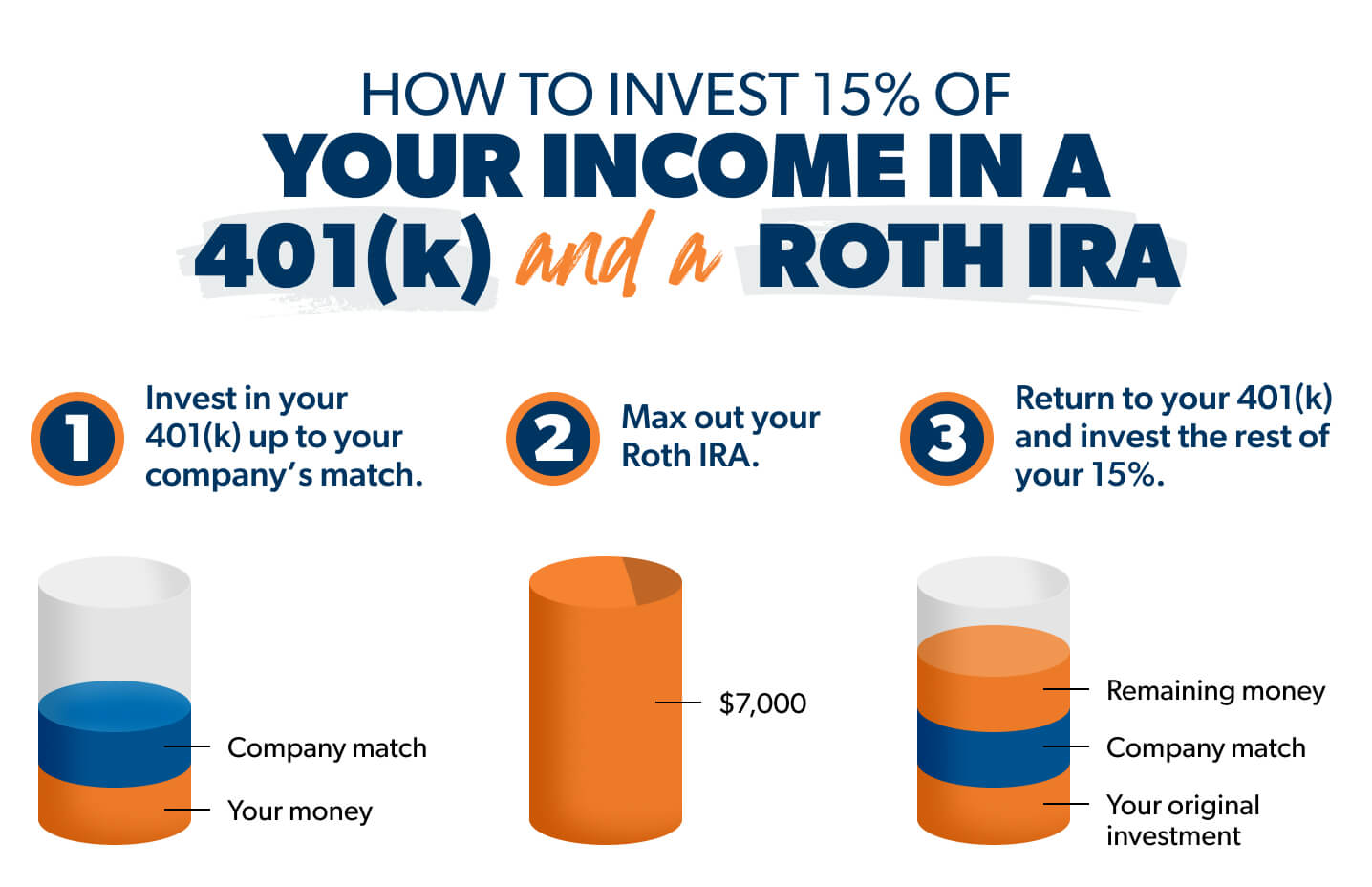

Roth 401 K

https://cdn.ramseysolutions.net/media/blog/retirement/investing/401k-vs-roth-ira.jpg

401k Performance 2025 Fawne Chelsae

https://learn.financestrategists.com/wp-content/uploads/Traditional_401k_Plan.png

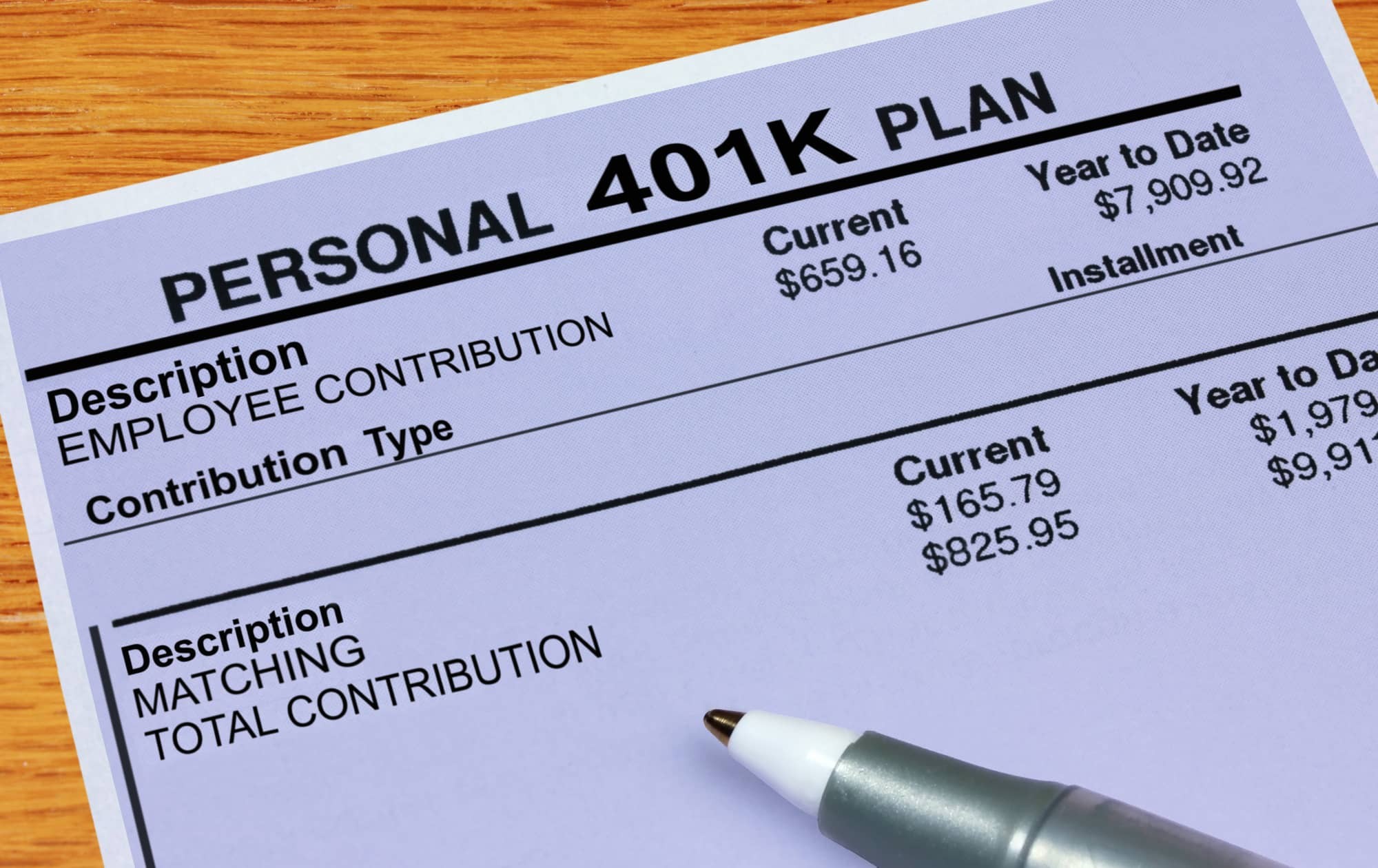

What Is a 401 k Plan Named after a section of the U S Internal Revenue Code the 401 k is a defined contribution plan provided by an employer The employer may match employee A SIMPLE 401 k is like a regular 401 k but with simplified employer matching Here s how it works and whether it makes sense for you

What is a SIMPLE 401 k A SIMPLE 401 k is a simple tax deferred retirement plan designed to make it simple for small business owners employees to save for retirement How does it work A SIMPLE 401 k is A SIMPLE 401 k plan or Savings Incentive Match Plan for Employees is a type of retirement plan designed for small businesses with 100 or fewer employees who earned

More picture related to What Is A Simple 401 K Plan

2025 401k Limits Catch Up Nastaran Tyler

https://insights.wjohnsonassociates.com/hubfs/Contribution Limits_BP_Blog_2023_11_1600x900_Over 50.png#keepProtocol

401 k Plans Are Employer sponsored Retirement Plans Where Employees

https://i.pinimg.com/originals/d3/70/c9/d370c986c574329ab1e1bfd858b50ff8.jpg

Types Of 401 k Plans Advantages And Who Can Contribute

https://www.sdretirementplans.com/wp-content/uploads/2021/10/Different-types-of-401K.png

A SIMPLE 401 k allows for vesting schedules similar to traditional 401 k plans Employers can use a graded vesting schedule where ownership increases gradually over A 401 k is an employer sponsored retirement plan With tax benefits and potential employer matching contributions a 401 k is a great way to save for retirement

SIMPLE 401 k plans The SIMPLE 401 k plan was created so that small businesses could have an effective cost efficient way to offer retirement benefits to their What is a SIMPLE 401 k and how does it work As the name implies a SIMPLE 401 k plan Savings Incentive Match Plan for Employees is a less complex 401 k account for small

401k Limit 2025 Roth Walter S Barlow

https://www.sensefinancial.com/wp-content/uploads/2016/10/Roth-Solo-401k.jpg

401 K Limits 2025 Chart Jasper B Spencer

https://insights.wjohnsonassociates.com/hubfs/Contribution Limits_BP_Blog_2023_11_1600x900_Over 50.png#keepProtocol

https://www.irs.gov › retirement-plans

Under a SIMPLE 401 k plan an employee can elect to defer some compensation But unlike a regular 401 k plan you the employer must make either A non

https://www.investopedia.com › articles › r…

For example instead of a traditional 401 k plan a small business owner can opt for a SIMPLE 401 k They sound similar but there are important differences between them that

Employee Employer Combined 401k Limits 2025 Sami Omar

401k Limit 2025 Roth Walter S Barlow

Types Of 401 K Plans For Small Business Business Walls

401k Limit 2024 Employer Contribution Abbie Shanda

Types Of 401k Plans Visual

401 k Plan Definition How It Works Types Features

401 k Plan Definition How It Works Types Features

401k Max Contribution 2025 Employer Mary F Crowe

2025 Pre Tax 401k Limit Darya Emelyne

401k Rollover Options How To Roll Over Your 401 k To An IRA

What Is A Simple 401 K Plan - SIMPLE 401 k plans work in much the same way as a regular 401 k allowing employees to make pre tax contributions from each paycheck The maximum contribution by