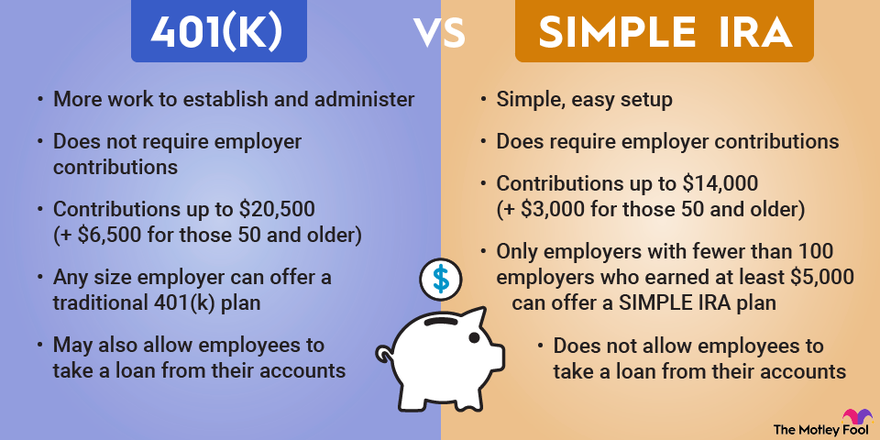

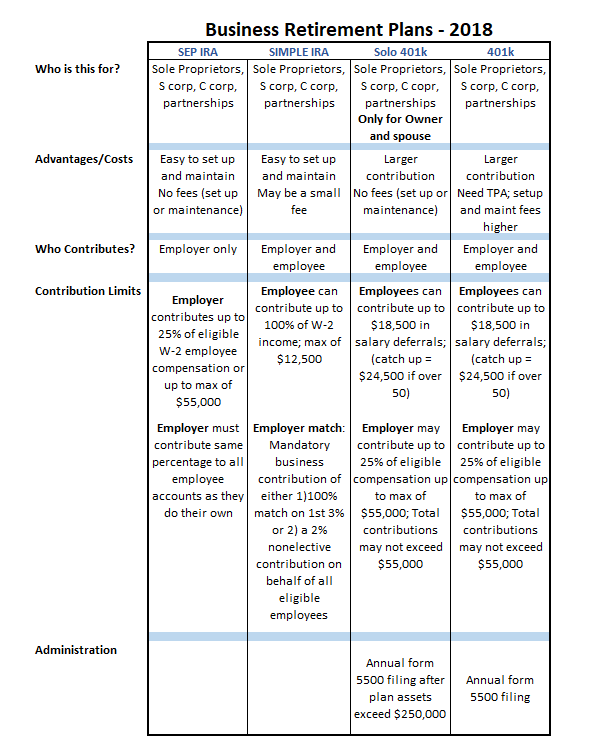

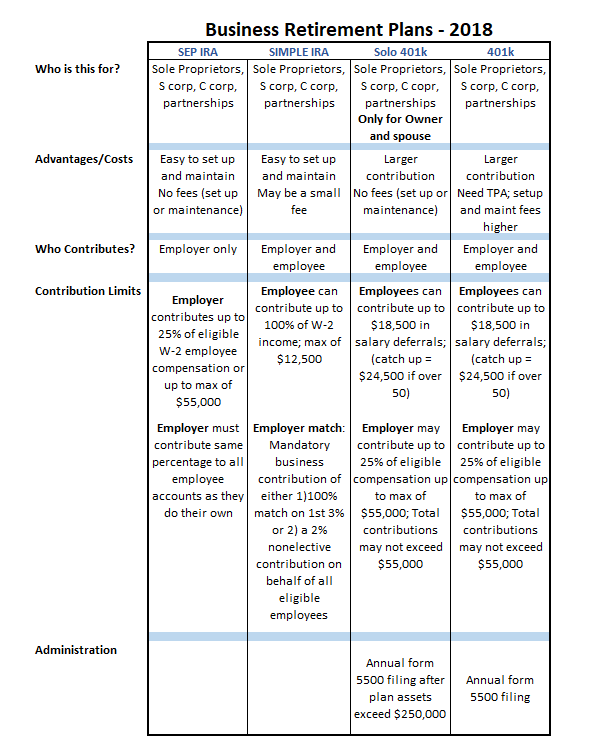

What Is The Difference Between A Sep And A Simple Retirement Plan We ll start with choosing between a SEP and a SIMPLE IRA plan A SEP plan is available to any sized business while a SIMPLE IRA is generally limited to small businesses

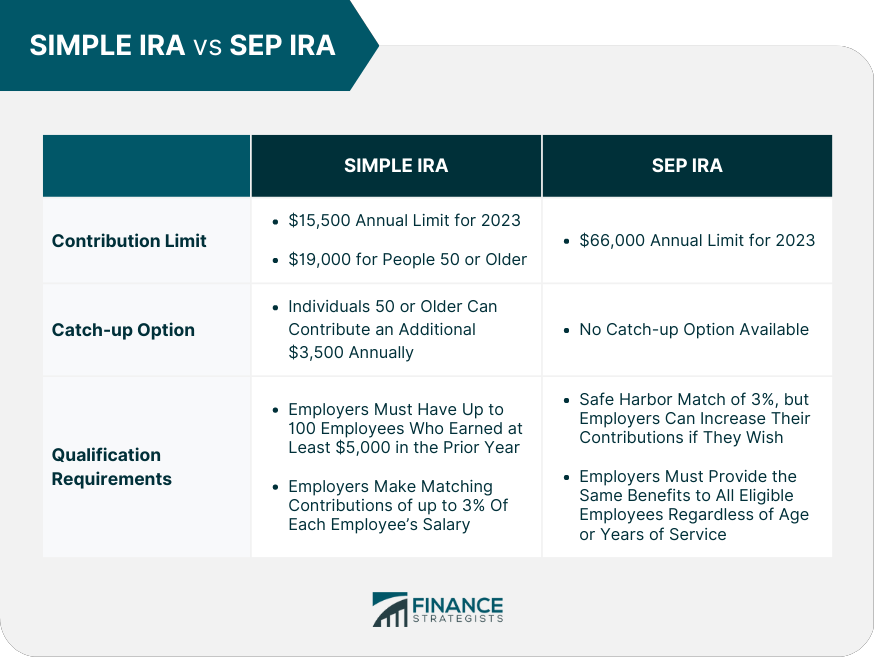

The main differences between a SIMPLE IRA and a SEP IRA are the contribution limits catch up options and qualification requirements The following table compares these two retirement savings plans side by side SEP IRAs and SIMPLE IRAs are retirement plans designed for self employed individuals and small business owners SEP IRA offers flexibility for contributions based on

What Is The Difference Between A Sep And A Simple Retirement Plan

What Is The Difference Between A Sep And A Simple Retirement Plan

https://m.foolcdn.com/media/dubs/images/401k-vs-SIMPLE-IRA-retirement-plans-infographi.width-880.png

Pin On Business

https://i.pinimg.com/originals/01/f1/e5/01f1e55c27499c2c751b346691710919.png

2025 Max Ira Contribution Khodadad Ruby

https://www.marinerwealthadvisors.com/wp-content/uploads/2019/11/401k-Advantages-Over-SEP-and-Simple-IRAs-1024x533.png

Here s how the SEP IRA compares to the SIMPLE IRA and the key factors you should consider when deciding between the two plans What is a SEP IRA SEP stands for Simplified Employee SEP IRA is the specific employee retirement account that is funded by the SEP SIMPLE is short for Savings Incentive Match PLan for Employees A Simplified Employee Pension plan can

Two popular retirement savings options for small business owners and self employed individuals are the SEP IRA and the SIMPLE IRA While both offer tax advantages they differ in terms of contributions eligibility and features There are a number of similarities and differences between the SEP IRA vs the SIMPLE IRA Exploring the pros and cons of each and comparing the two plans can help self employed people small business

More picture related to What Is The Difference Between A Sep And A Simple Retirement Plan

What Is Difference B Images

https://www.yourinfomaster.com/wp-content/uploads/2023/05/What-is-the-difference-between-medicare-A-and-B.jpg

2025 Max Sep Ira Contribution Liam Michael

https://sharedeconomycpa.com/wp-content/uploads/2022/05/table1.jpg

Fidelity Simple Ira Contribution Limits 2025 Frank M Cooper

https://focushr.net/wp-content/uploads/2019/09/Simple-IRA.png

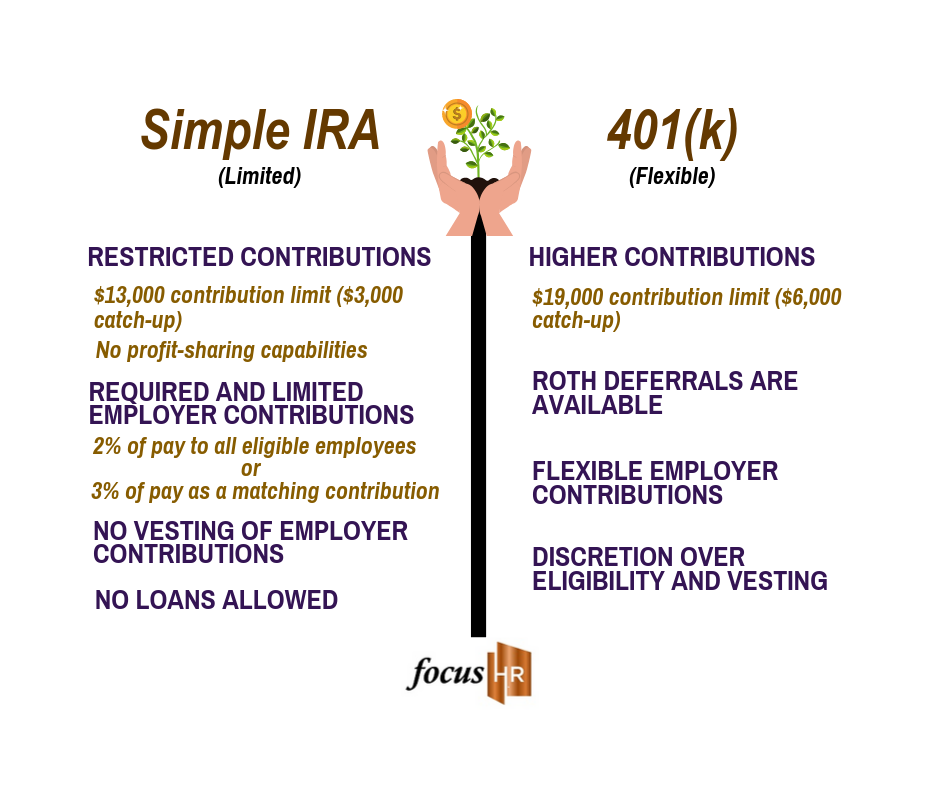

Understanding the differences between an SEP IRA vs a Simple IRA and how to tell if your company has outgrown these options is crucial in making an informed decision for your company s employee benefit strategy SEP IRAs and SIMPLE IRAs are key in retirement strategies for small enterprises SEP IRAs offer major tax benefits and are simple to manage without requiring yearly contributions SIMPLE IRAs however have a fixed

Understanding the differences between a SIMPLE IRA and a SEP IRA is essential in finding the right fit for your business and employees From contribution limits to eligibility requirements SEP and SIMPLE IRAs are both retirement plans tailored for small businesses and self employed individuals SEP IRA is funded solely by the employer while a SIMPLE IRA

Sep Ira Contribution Limits 2025 Due Date Marya Leanora

https://www.carboncollective.co/hs-fs/hubfs/A_Side_by_Side_Comparison_of_SEP_and_Simple_IRA.png?width=3588&name=A_Side_by_Side_Comparison_of_SEP_and_Simple_IRA.png

401k Contribution Limits 2025 Chart William K Taylor

http://www.marottaonmoney.com/wp-content/uploads/2016/08/retirement-plan-contribution-limits-2016.jpg

https://www.irs.gov › pub › irs-tege

We ll start with choosing between a SEP and a SIMPLE IRA plan A SEP plan is available to any sized business while a SIMPLE IRA is generally limited to small businesses

https://www.financestrategists.com › retire…

The main differences between a SIMPLE IRA and a SEP IRA are the contribution limits catch up options and qualification requirements The following table compares these two retirement savings plans side by side

Hsa Limits In 2025 Rami Belle

Sep Ira Contribution Limits 2025 Due Date Marya Leanora

2025 Hsa Contribution Limits 55 Plus Paola Annamarie

2025 Sep Ira Limits Feliza Lynett

Simple Ira Max 2025 Laura Morgana

Financial Planning For Business Owners In Orlando AllGen

Financial Planning For Business Owners In Orlando AllGen

Simple Retirement Letter To Employee

Differences Between Diagrams And Schematics Wiring Schematic

Simplified Employee Pension Vs SIMPLE IRA How Do They Differ

What Is The Difference Between A Sep And A Simple Retirement Plan - The primary difference between a SIMPLE IRA and a SEP IRA are who is allowed to fund the retirement accounts and the contribution limits Both a SIMPLE IRA and a SEP IRA