What States Have Zero Property Tax For 100 Disabled Veterans 100 Disabled Veterans Our research and analysis uncovered 20 states with no property tax for 100 disabled veterans meaning eligible veterans are completely exempt from paying property taxes on their primary residence

Veterans who are 100 percent totally disabled or entitled as 100 percent disability rate due to unemployability and honorably discharged may be granted an exemption of up to 50 000 plus an additional amount from paying However there are a few states that have no property tax for 100 disabled veterans In this article we will explore which states offer this benefit and the specific

What States Have Zero Property Tax For 100 Disabled Veterans

What States Have Zero Property Tax For 100 Disabled Veterans

https://i.ytimg.com/vi/5qTcTTTpmVk/maxresdefault.jpg

Veteran Tax Exemption 100 Disabled Veteran Benefits YouTube

https://i.ytimg.com/vi/9IynZhqWHbA/maxresdefault.jpg

What Benefits Are Available To 100 Disabled Veterans Can You Work

https://i.ytimg.com/vi/LbGDDiAvppQ/maxresdefault.jpg

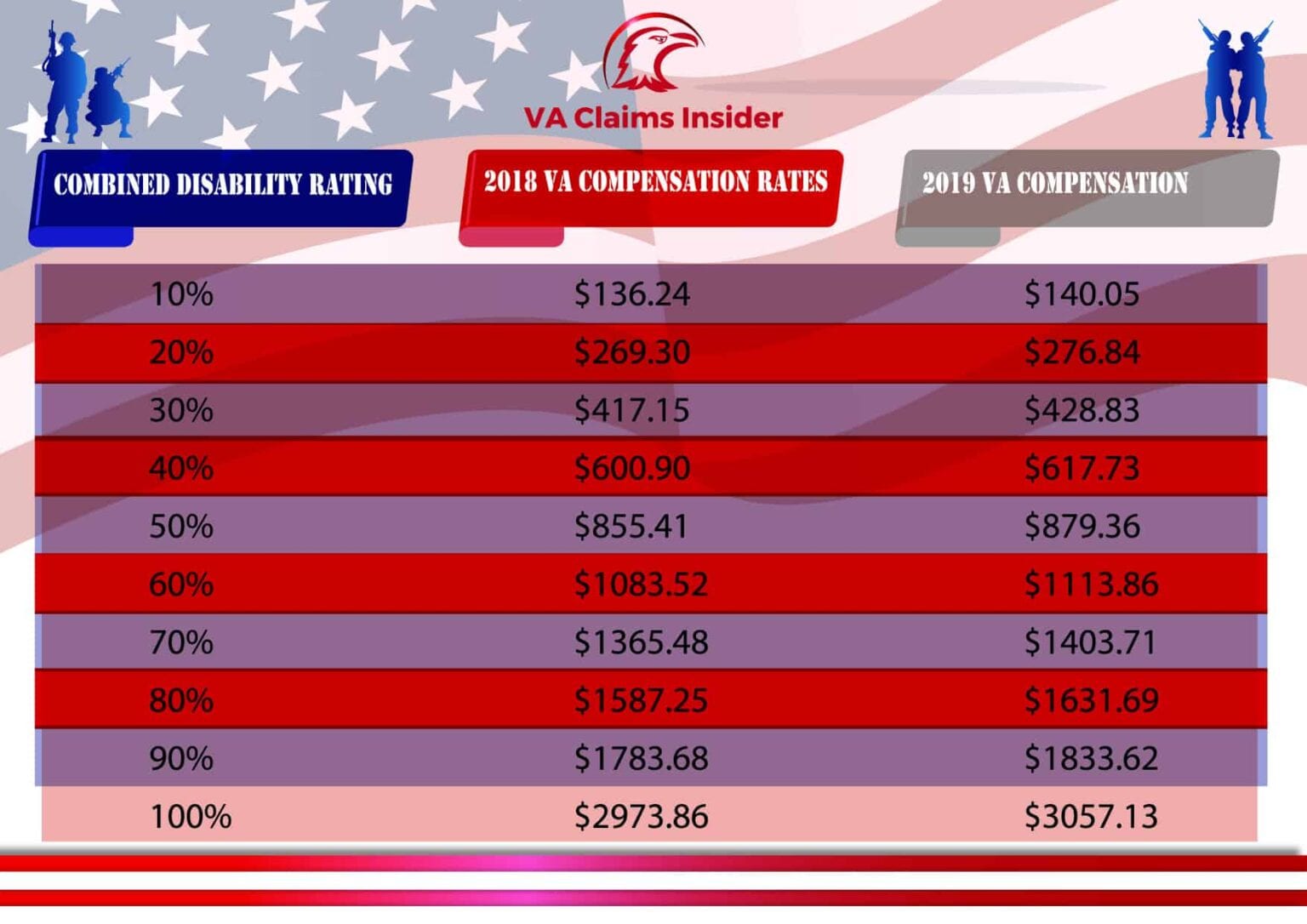

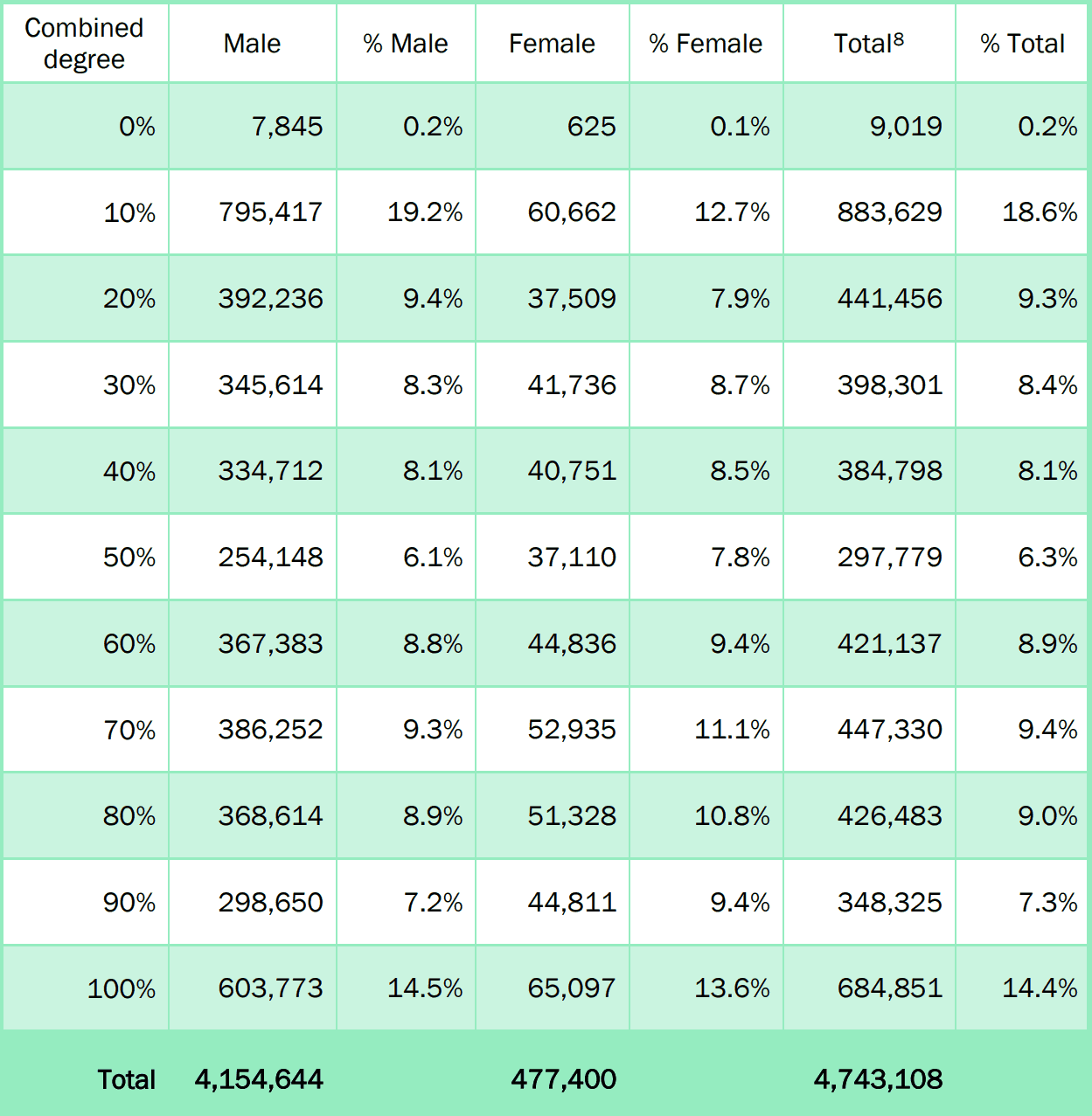

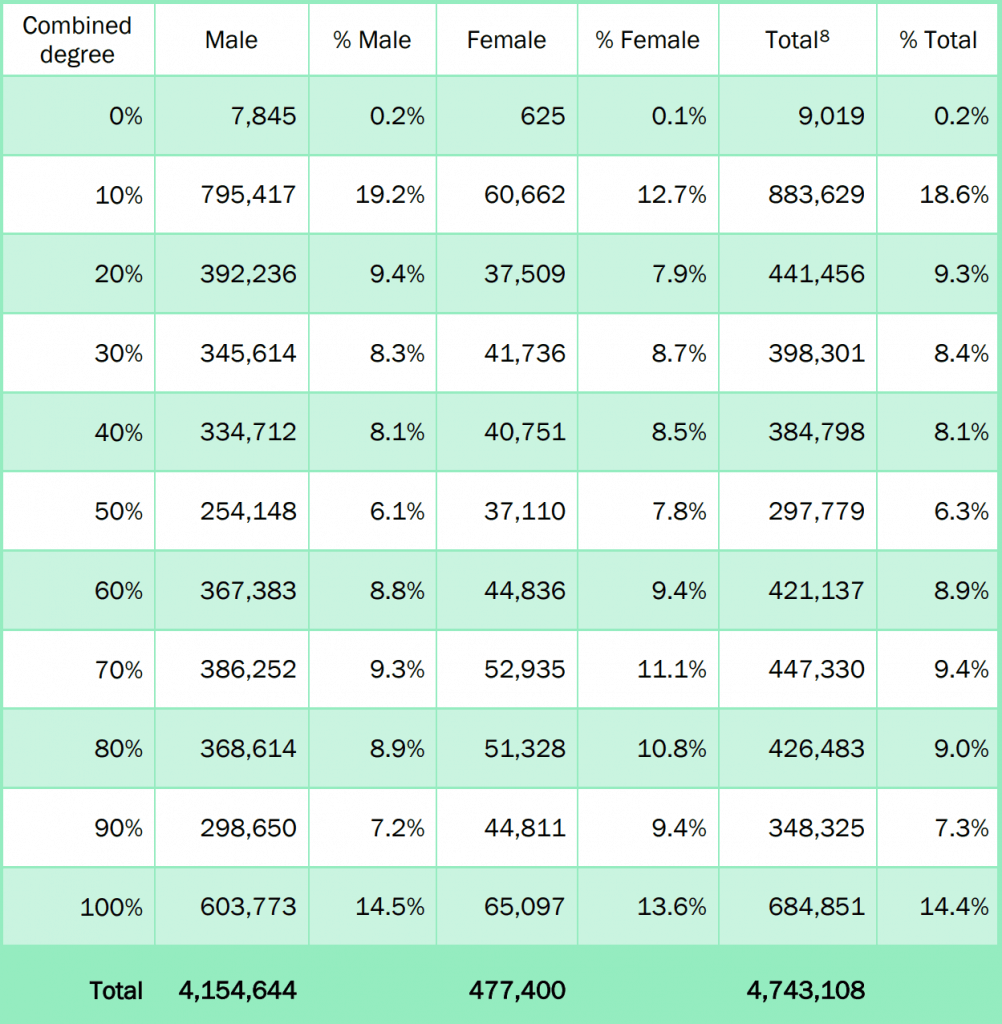

Some states offer a complete exemption from property taxes for veterans who meet specific criteria usually those with a 100 disability rating In other cases the exemption might be a percentage reduction of the total Veterans who have 100 disabled status are eligible to reduce their property taxes by as much as 1 320 on their primary residence via a VA tax exemption Illinois Returning Illinois veterans receive a 5 000 reduction in the assessed

According to the Nebraska Department of Revenue veterans with service connected disability with a VA rating of 100 are exempt from paying state property taxes regardless of income level or value of the property Delaware Veterans with a 100 disability rating who have been residents of the state for at least three years can be eligible for a tax credit of 100 of non vocational school

More picture related to What States Have Zero Property Tax For 100 Disabled Veterans

What States Have No Property Tax For 100 Disabled Veterans

https://i.ytimg.com/vi/1c-4KUWChzk/maxresdefault.jpg

Disabled Veterans

https://tax-office.traviscountytx.gov/images/dv-license-plate.JPG

Va Rates 2024 Increase In India Noell Angelina

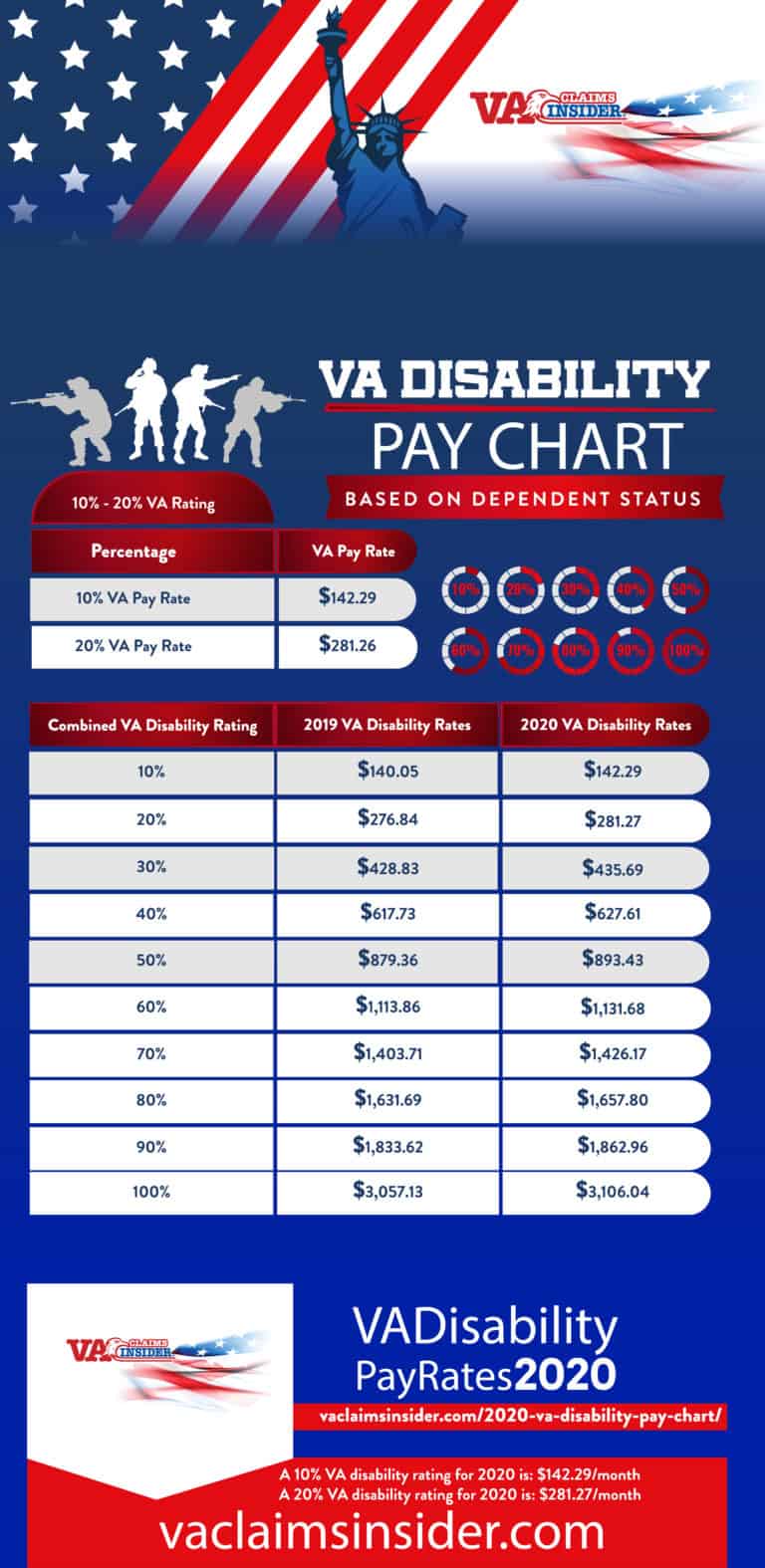

https://vaclaimsinsider.com/wp-content/uploads/2019/10/2020-VA-Disability-Pay-Chart-768x1575.jpg

It s exciting to know that most states across the U S offer property tax exemptions to disabled veterans Here s a snapshot 1 California The Golden State provides a basic 100 000 exemption for veterans with a total disability Only 12 states offer full property tax exemption for disabled veterans while others offer partial exemptions grants or other forms of relief Alabama Disabled veterans with a

We found 11 states that exempt the residence of totally disabled veterans from property taxes In each of these states the veteran s surviving spouse is entitled to the benefit as long as he or Requirements for a disabled veteran property tax exemption will vary from state to state but almost every state provides some sort of property tax exemption for Veterans who

Va Benefits For 2023

https://vaclaimsinsider.com/wp-content/uploads/2022/10/2023-VA-Disability-Pay-Chart-2048x1229.jpg

Multiplying By Zero Rule

https://i.ytimg.com/vi/AKQGe50NIVg/maxresdefault.jpg

https://vaclaimsinsider.com › disabled-vete…

100 Disabled Veterans Our research and analysis uncovered 20 states with no property tax for 100 disabled veterans meaning eligible veterans are completely exempt from paying property taxes on their primary residence

https://themilitarywallet.com › property-ta…

Veterans who are 100 percent totally disabled or entitled as 100 percent disability rate due to unemployability and honorably discharged may be granted an exemption of up to 50 000 plus an additional amount from paying

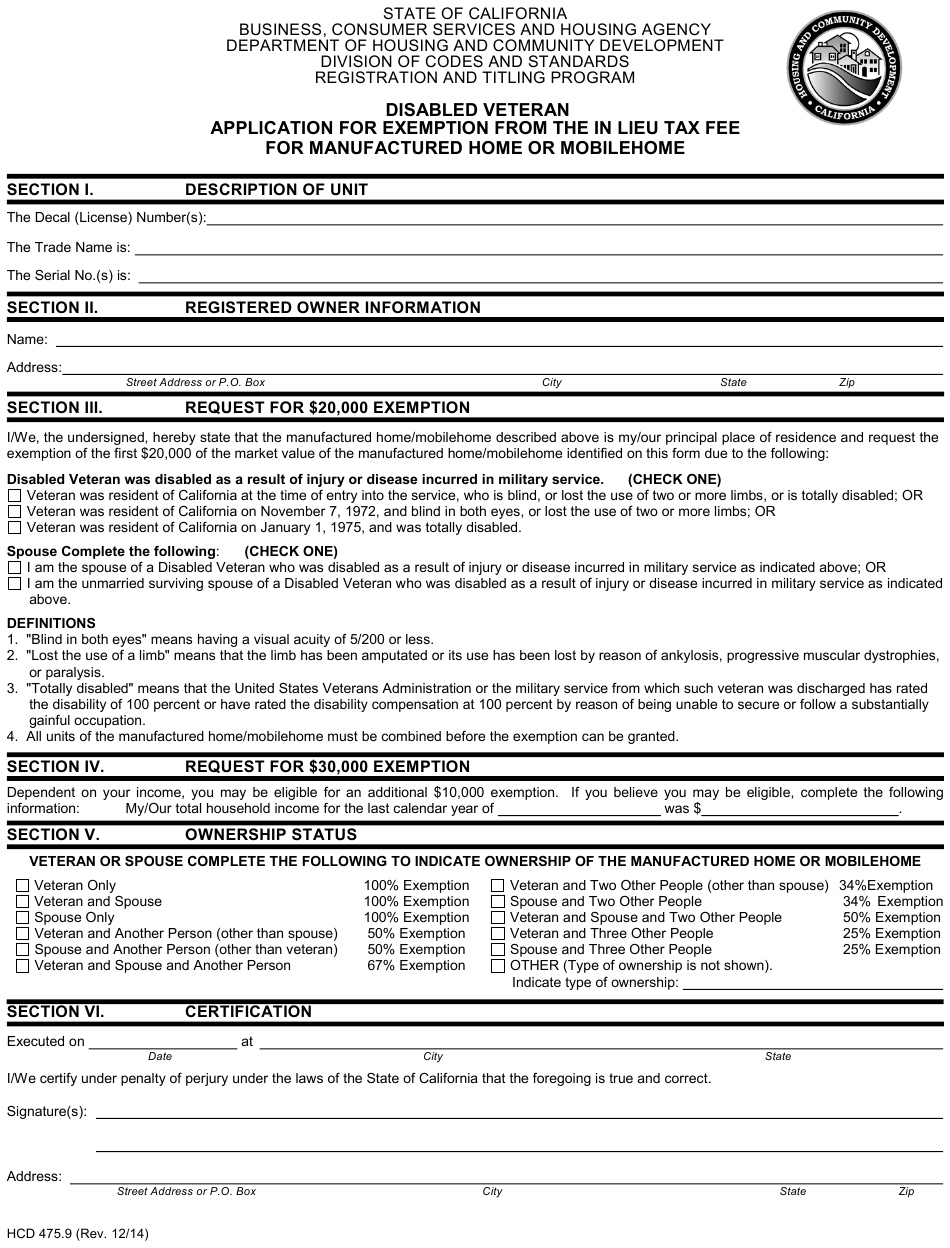

Disability Car Tax Exemption Form ExemptForm

Va Benefits For 2023

Va Benefits Amount 2024

Va Disability Rating For 2025 Benefits Prudy Tomasina

Va Disability Payment Scale 2024

Tax Form For Disability Veteran Veterans Affairs

Tax Form For Disability Veteran Veterans Affairs

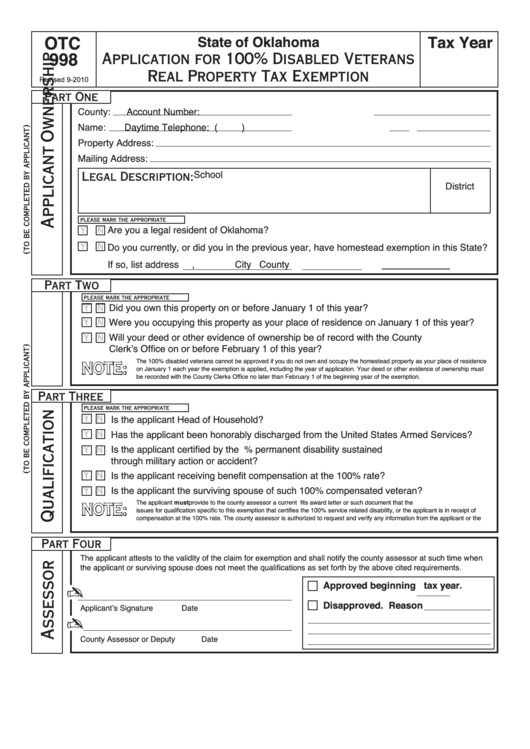

Fillable Form Otc998 Application For 100 Disabled Veterans Real

Usaa Va Disability Pay Dates 2024

Va Disability Rates 2025 Chart Ann D Correia

What States Have Zero Property Tax For 100 Disabled Veterans - Delaware Veterans with a 100 disability rating who have been residents of the state for at least three years can be eligible for a tax credit of 100 of non vocational school