When Can I Rollover My Roth 401k To A Roth Ira You should be able to roll over your 401 k into a Roth IRA but be prepared to pay taxes when you make the transition When you withdraw funds they won t be taxed

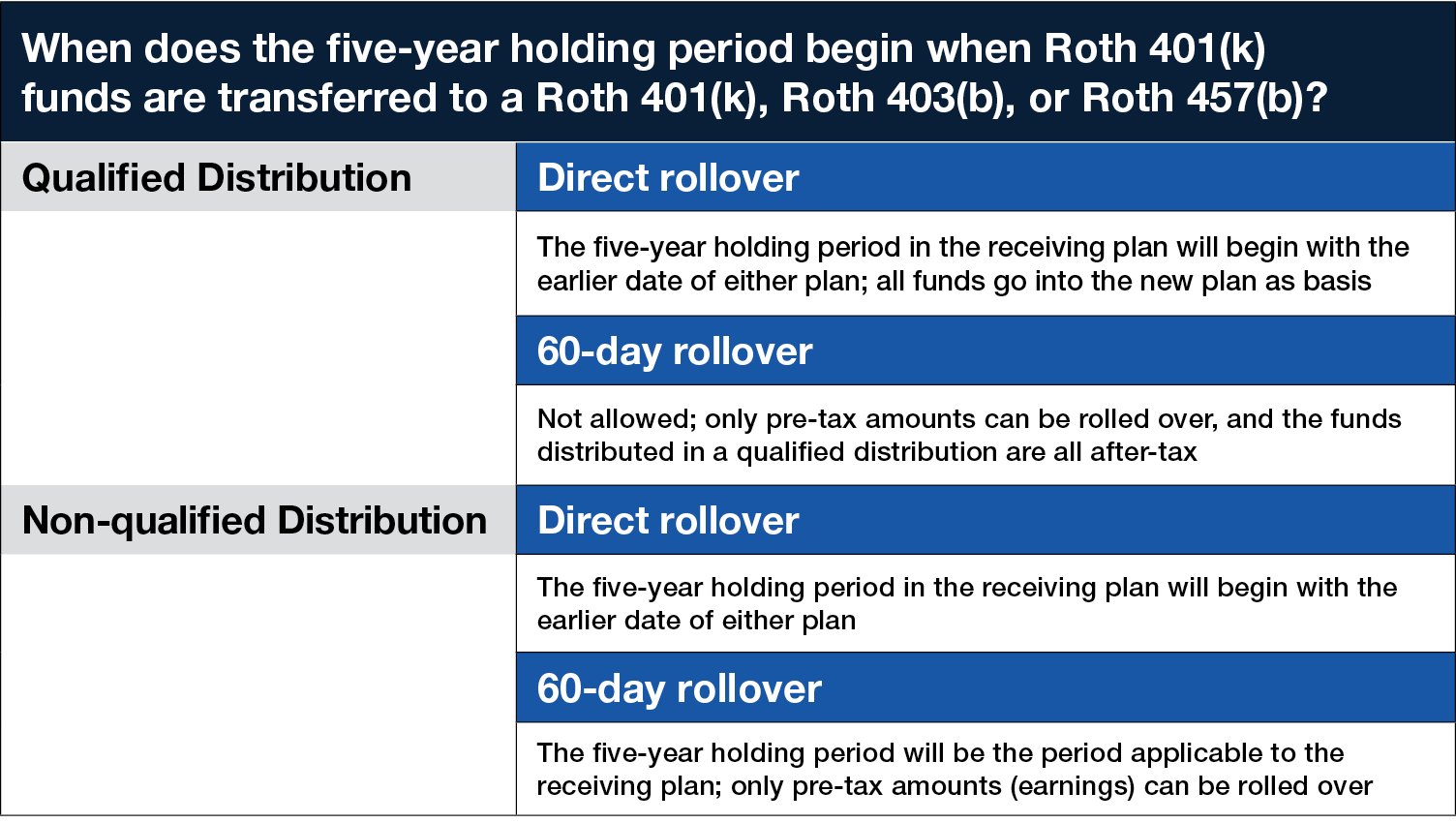

There are three ways you can roll a Roth 401 k over A direct rollover Your plan custodian can cut a check made out to the new account which you take or send to the new account custodian Rolling over a Roth 401 k to a Roth IRA If you re not privy to the rule you can take a Roth 401 k you have had for over 5 years and move it to a Roth IRA you just stared This will cause you to lose your holding period the time your plan is active

When Can I Rollover My Roth 401k To A Roth Ira

When Can I Rollover My Roth 401k To A Roth Ira

https://i.ytimg.com/vi/BOSn2UwZWC4/maxresdefault.jpg

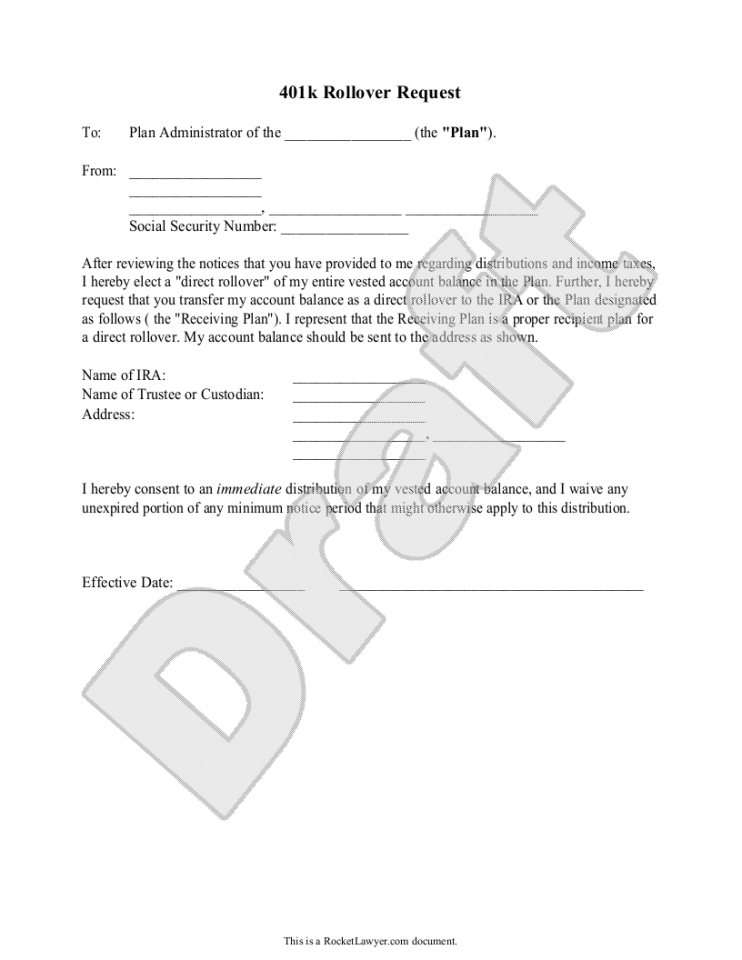

401k Rollover Letter Template

https://www.samplewords.com/wp-content/uploads/2015/06/401k-rollover-742x960.png

1099 Pension

https://www.solo401k.com/wp-content/uploads/Screen-Shot-2023-01-11-at-2.59.20-PM-1024x780.png

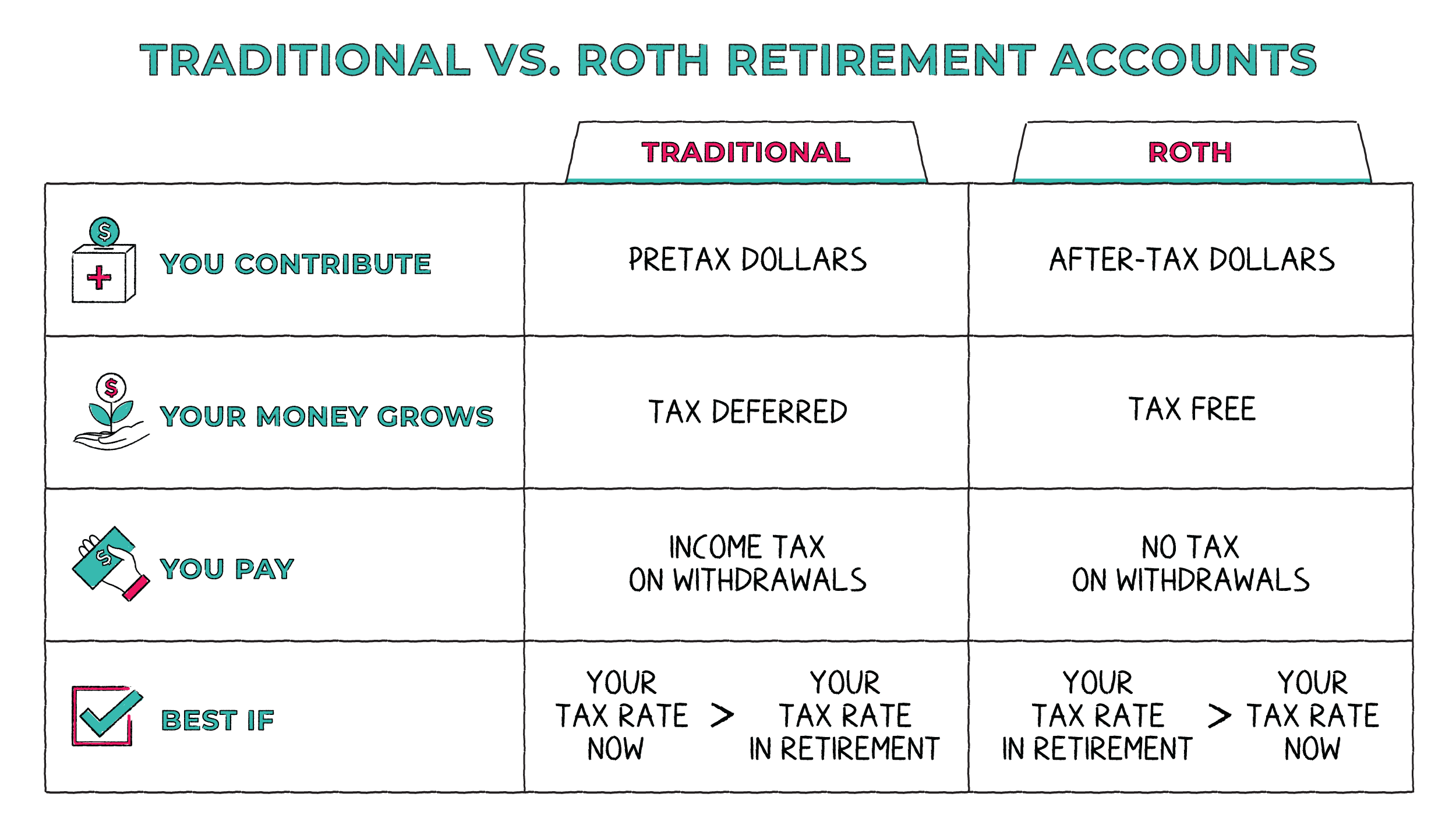

What s a Roth IRA conversion If you own a traditional IRA or other non Roth IRA or have an old workplace retirement plan such as a 401 k 403 b or 457 b you can pay taxes on your account to move your savings to a Roth IRA letting you enjoy the potential for future tax free growth Rollover to Your Roth IRA Amounts rolled over from a Roth 401 k to a Roth IRA take on the characteristics of the Roth IRA including determining whether a distribution from the Roth IRA is taxable

Rolling over a Roth 401 k to a Roth IRA preserves tax free withdrawals and provides more investment options Contact your plan administrator for a trustee to trustee transfer to avoid tax When Is Rolling Over Your Roth 401 k To a Roth IRA a Good Idea If you consider leaving a job rolling over a Roth 401 k to a Roth IRA can be a good idea This enables you to move money from your old plan straight into your new employer s plan without having to pay taxes or penalties

More picture related to When Can I Rollover My Roth 401k To A Roth Ira

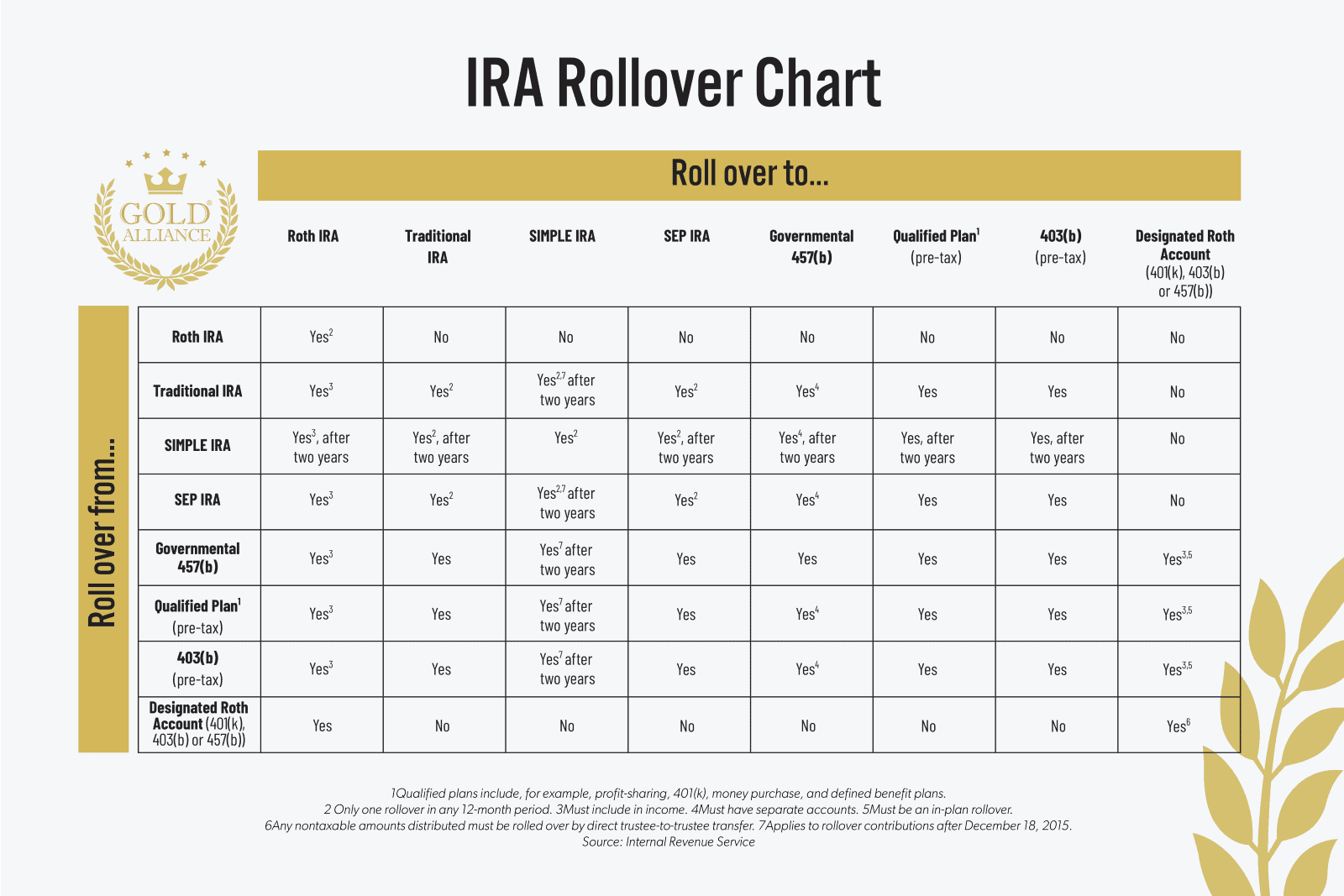

Ira Rollover Rules Choosing Your Gold IRA

https://goldalliance.com/wp-content/uploads/2022/03/image.png

What Is 401K IRA Vs 401K Retirement Answers From Napkin Finance

https://napkinfinance.com/wp-content/uploads/2019/01/NapkinFinance-IRAvs401k-Chart-07-31-20-v02.png

What Is A Roth 401 k Here s What You Need To Know TheSkimm

https://www.theskimm.com/_next/image?url=https://images.ctfassets.net/6g4gfm8wk7b6/6C2dwsIzDhqx0ZlHlJbPdm/8bfbea89445676b07e35a62db8c3c548/Roth_401k.png&w=3840&q=75

You can roll over 401 k to a Roth IRA without penalty as long as you follow the 60 day rule if you re doing an indirect rollover You must deposit the funds into a Roth IRA within 60 days to avoid a penalty When rolling over a 401 k to a Roth IRA the first step is determining if the funds are eligible for distribution Generally individuals can roll over funds if they have left their employer or are 59 or older

A 401 k rollover simply allows you to transfer your retirement savings from a 401 k you had at a previous job into an IRA or another 401 k with your new employer And you won t have to pay any taxes on the money you transfer in most cases Yes once retired or while still working if your plan permits in service withdrawals from your 401 k You can convert your traditional 401 k either through a direct rollover to a Roth IRA or by rolling funds over to a traditional IRA and then converting to a Roth IRA

Retirement Comparison Chart

https://www.moneylend.net/wp-content/uploads/retirement_compare.jpg

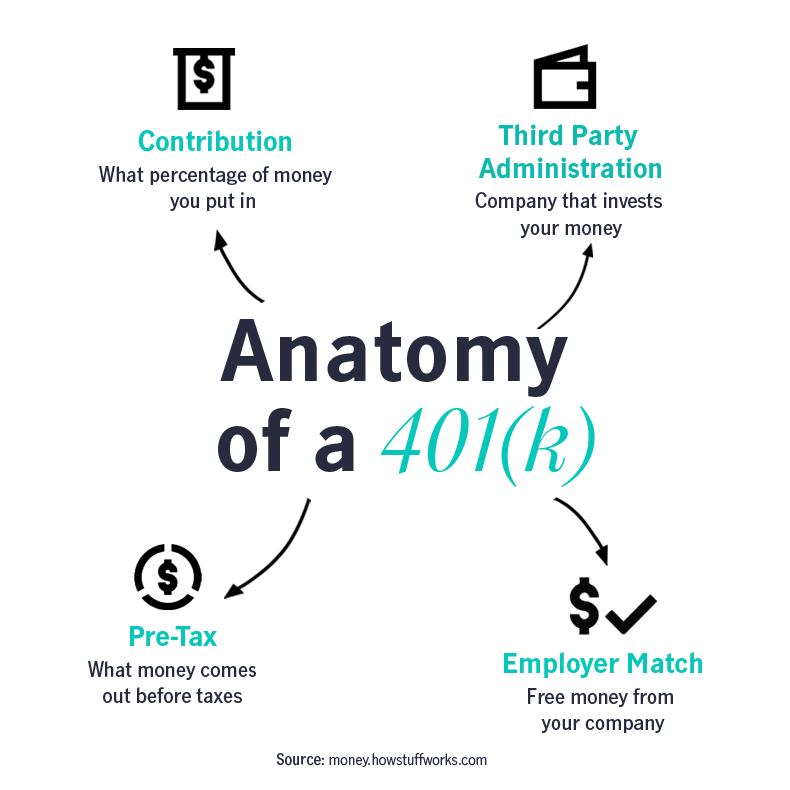

401k Rollover Choosing Your Gold IRA

https://www.johnhancock.com/content/dam/onejohnhancock/articles/401k-rollover-real-talk/Anatomyofa401k.png

https://www.investopedia.com › articles › retirement

You should be able to roll over your 401 k into a Roth IRA but be prepared to pay taxes when you make the transition When you withdraw funds they won t be taxed

https://www.investopedia.com › articles › retirement

There are three ways you can roll a Roth 401 k over A direct rollover Your plan custodian can cut a check made out to the new account which you take or send to the new account custodian

Backdoor Roth Ira 2025 Tamara J Clarke

Retirement Comparison Chart

Roth 401 K

Roth Ira Limit 2025 Contribution Images References Amira Sage

Roth 401k Rollover

Roth 401k Rollover

Roth 401k Rollover

Roth 401k Rollover

Building A Roth Conversion Ladder Retirement Nerd

2024 401k Limits Irs Caryl Consolata

When Can I Rollover My Roth 401k To A Roth Ira - What s a Roth IRA conversion If you own a traditional IRA or other non Roth IRA or have an old workplace retirement plan such as a 401 k 403 b or 457 b you can pay taxes on your account to move your savings to a Roth IRA letting you enjoy the potential for future tax free growth