At What Income Can You Not Contribute To An Ira Canada Disability Benefit The Canada Disability Benefit provides direct financial support to people with disabilities who are between 18 and 64 years old The program is

Income is reported and tax is calculated on an annual basis To reflect a one percentage point cut in the lowest tax rate coming into effect halfway through the year the full Just how much tax can you save You save tax by investing in a retirement annuity But the amount of tax you save depends on your income level This table shows how much tax you

At What Income Can You Not Contribute To An Ira

At What Income Can You Not Contribute To An Ira

https://www.bankwith1st.com/wp-content/uploads/2022/12/Traditional-IRAs-vs-Roth-IRAs-Comparison.png

How Much Can I Contribute To My Roth IRA 2023 YouTube

https://i.ytimg.com/vi/q_CNvH1LKhY/maxresdefault.jpg

Contribute

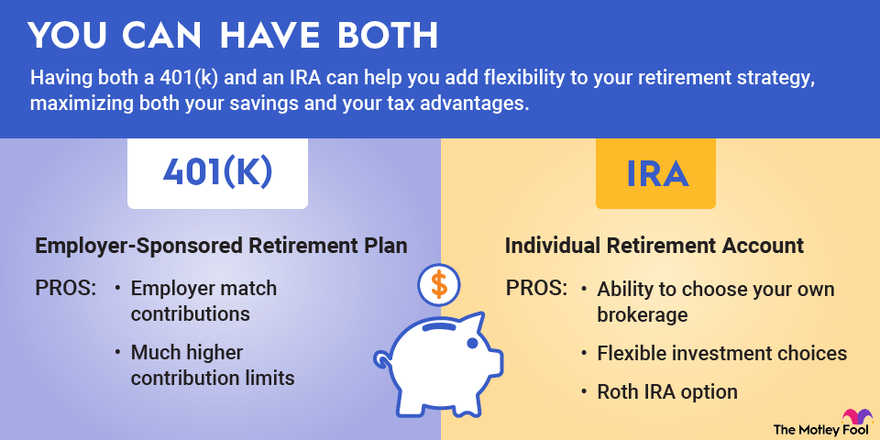

https://m.foolcdn.com/media/dubs/images/contributions-to-401k-and-IRA-infographic.width-880.png

Today you can start filing your 2024 income tax return online For most individuals the deadline to file is April 30 2025 and any amounts owed must also be paid by Income tax calculator Updated for 2024 25 tax year how much tax will you pay on your salary in South Africa find out with the SARS income tax calculator updated for 2024 25 tax year

Deducting tax from income not subject to CPP contributions or EI premiums We have built the tax credits for CPP contributions and EI premiums into the federal tax For amounts based on your specific income use the Old Age Security OAS estimator If you lived in Canada for at least 10 years but less than 40 years after age 18 you will receive a

More picture related to At What Income Can You Not Contribute To An Ira

Irs Fica Limit 2024 Carin Cosetta

https://www.personalfinanceclub.com/wp-content/uploads/2021/11/2021-11-12-2022-Roth-IRA-Income-Limits-1024x1024.png

Roth Ira Limit 2025 Contribution Images References Amira Sage

https://www.theentrustgroup.com/hs-fs/hubfs/2024-ira-contribution-limits.jpg?width=3072&height=2925&name=2024-ira-contribution-limits.jpg

2025 401k Contribution Limit Karen Fisher

https://www.personalfinanceclub.com/wp-content/uploads/2021/11/2021-11-07-2022-401k-IRA-Limits-1536x1536.png

How to work out how much tax you will pay on your bonus manually Step 1 Determine your taxable income for the year by multiplying your monthly salary by 12 Step 2 As an employee you complete this form if you have a new employer or payer and will receive salary wages or any other remuneration or if you wish to increase the amount of

[desc-10] [desc-11]

Max Magi For 2025 Roth Contribution Adrian Bernardes

https://meldfinancial.com/wp-content/uploads/IRA-Contribution-Limits-in-2023-846x630.jpg

2024 401k Limits Irs Caryl Consolata

https://www.personalfinanceclub.com/wp-content/uploads/2021/11/2021-11-07-2022-401k-IRA-Limits-1024x1024.png

https://www.canada.ca › en › services › benefits › disability › canada-dis…

Canada Disability Benefit The Canada Disability Benefit provides direct financial support to people with disabilities who are between 18 and 64 years old The program is

https://www.canada.ca › en › department-finance › news › delivering-a-…

Income is reported and tax is calculated on an annual basis To reflect a one percentage point cut in the lowest tax rate coming into effect halfway through the year the full

Maximum Hsa Contribution 2025 Over 55 Family Regina S Warren

Max Magi For 2025 Roth Contribution Adrian Bernardes

401k 2025 Grace Barber

Income Limits For Roth Ira 2025 Maya A Radford

Roth Ira Income Limits 2024 Irs Harli Abagail

2025 Roth Ira Contribution Limits Income Natalie Carter

2025 Roth Ira Contribution Limits Income Natalie Carter

2025 401k Limits Over 55 Full Ricky D Chitwood

Phfa K Fit Income Limits 2025 Virginia J Skinner

IRA Contribution Limits In 2023 Meld Financial

At What Income Can You Not Contribute To An Ira - For amounts based on your specific income use the Old Age Security OAS estimator If you lived in Canada for at least 10 years but less than 40 years after age 18 you will receive a