How Much Expenses Can I Claim For Working From Home As a sole trader working from home you can claim back part of the expenses associated with having a home office to reduce your tax bill HMRC refers to this as the use home as office allowance This calculator will help you figure out how much you can reasonably claim

Allowable expenses are essential business costs that self employed individuals and employees can claim even when working from home You can claim working from home tax deductions on various costs such as rent or mortgage payments and utility bills There are two ways to claim expenses either on your annual tax return if you file one or on a special form called a P87 which is available electronically via Government

How Much Expenses Can I Claim For Working From Home

How Much Expenses Can I Claim For Working From Home

https://i.ytimg.com/vi/-5BfVvZ_4Gg/maxresdefault.jpg

Daily Expense Report Template Atlanticcityaquarium

https://newdocer.cache.wpscdn.com/photo/20190830/cfb8a944d48f426c8ee793f48130f526.jpg

![]()

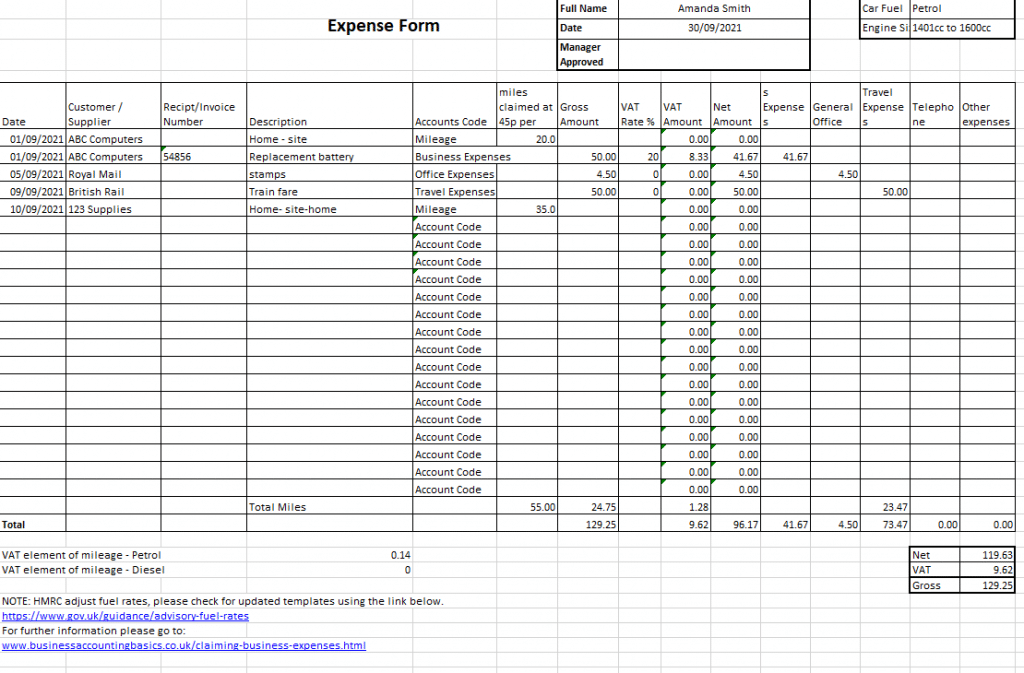

Excel Expense Tracker Template Db excel

https://db-excel.com/wp-content/uploads/2017/03/excel-expense-tracker-template.jpg

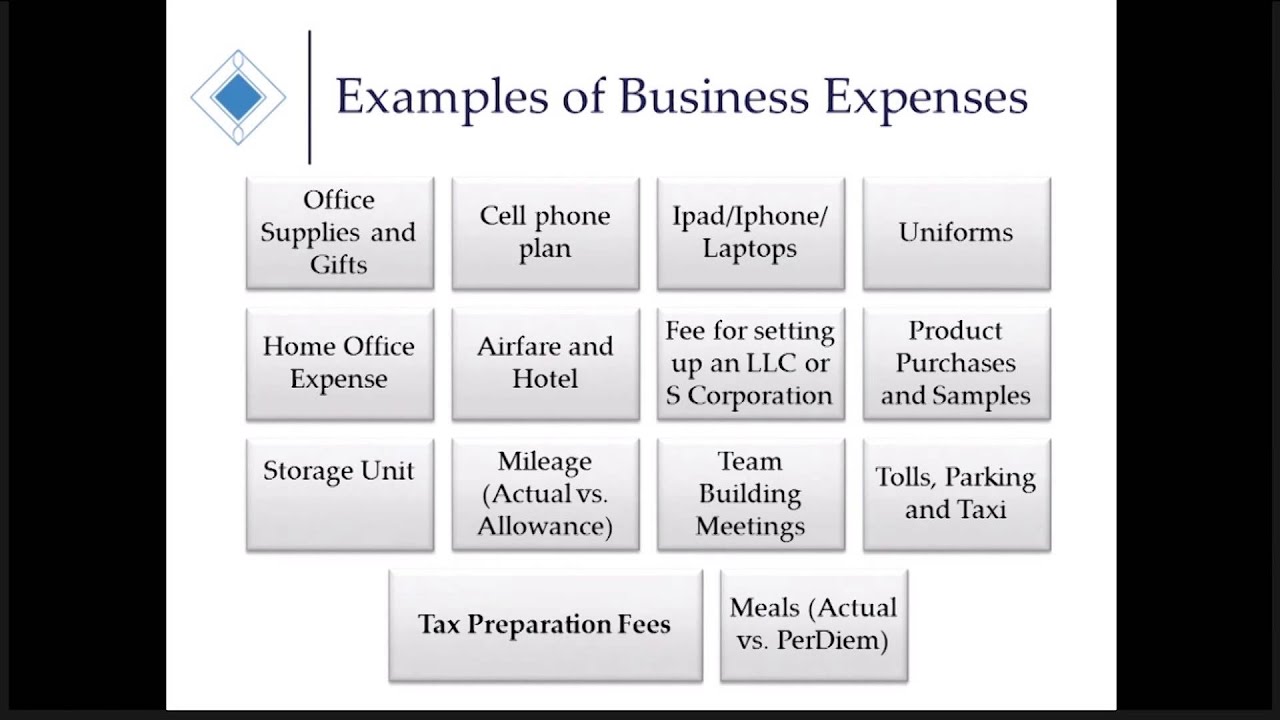

What Home Office Expenses Can I Claim for Working From Home How Do You Claim Tax Relief for Working from Home 1 Flat Rate Allowance 6 per week 2 Actual Additional Expenses How Much Working From Home Tax Relief Will I Get Can I Claim Work From Home Tax Relief for Previous Years For the 2022 23 tax year and beyond HMRC allows employees who work from home to claim a flat rate of 6 per week or 26 per month This means you do not need to provide receipts or bills when claiming this fixed amount However you must have evidence that you are required to work from home

Essentially you can claim a flat rate of expenses based on the number of hours you work from home each month 26 for 101 hours or more The simplified expenses method just covers heat light and power costs You could include those costs in your actual cost claim if it s certain to be more advantageous to your business Working from home can be a cost effective and convenient option for lots of self employed people removing the need to pay for additional premises or travel to them Claiming expenses for running your business from home can be a bit complicated though with different methods for working out your expense claim and slightly different rules depending on whether

More picture related to How Much Expenses Can I Claim For Working From Home

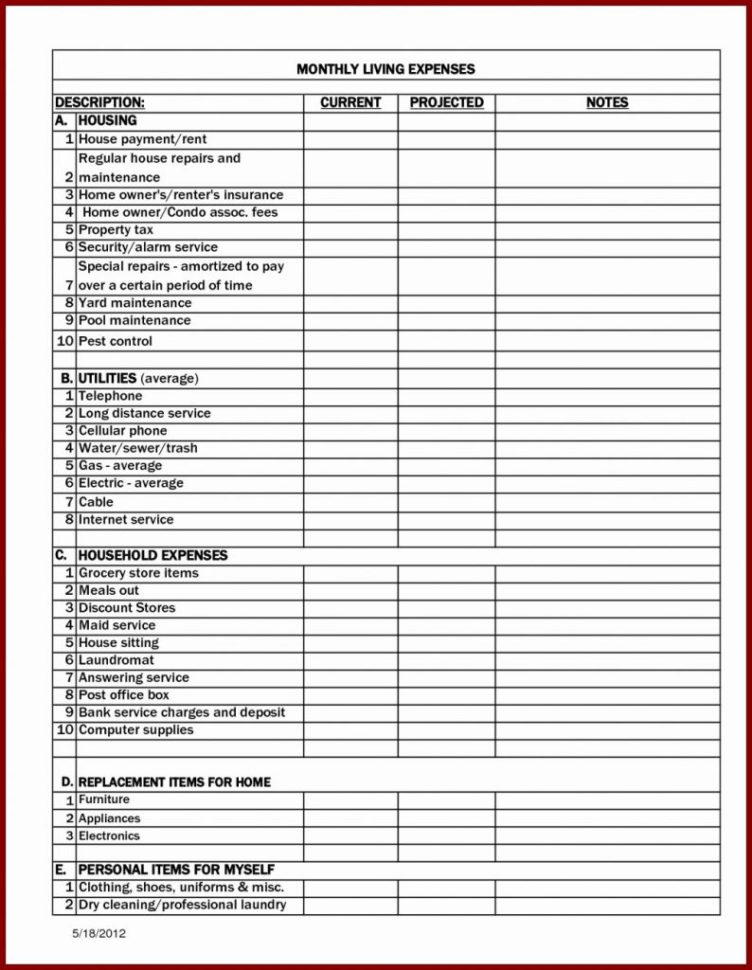

Contractor Expenses List Sakiimaging

https://images.ctfassets.net/ifu905unnj2g/4YZTnk6Kv20hdUNgkt60lc/e4148669b50768645e2773364dc98891/Bench_Income_statement_template.png

90 Percent Va Disability 2025 Joseph K Brown

https://va-disability-rates.com/wp-content/uploads/2021/08/2021-va-disability-compensation-rates-va-increase-1.jpg

Nc Income Tax Standard Deduction 2025 Cherin Kara Lynn

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

There are two methods that you can use to work out how much tax relief you re entitled to Simplified expenses are basically flat rates which are set by HMRC Or you can claim for a proportion of your costs according to the floor area your home workspace takes up If you only work from home for a few hours a week or you pay a very small amount towards your rent or mortgage a simple option is to claim a flat rate A flat rate is assigned to the number of hours you work from home per month and there are 3 different rates to choose from

The amount you can claim through the HMRC Working From Home Allowance depends on the duration you ve worked from home and your tax bracket As of the 2023 24 tax year you can claim 6 per week which adds up to 312 for the entire year if you worked from home for the full 52 weeks If you re self employed and work from home to run your sole trader business you may be able to claim tax relief on some of your home working expenses We explain the different methods of working out your expenses if you work from home and how to claim them back against your tax bill

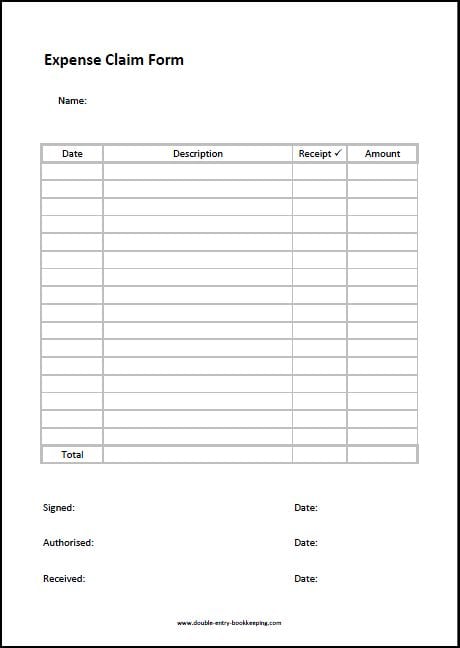

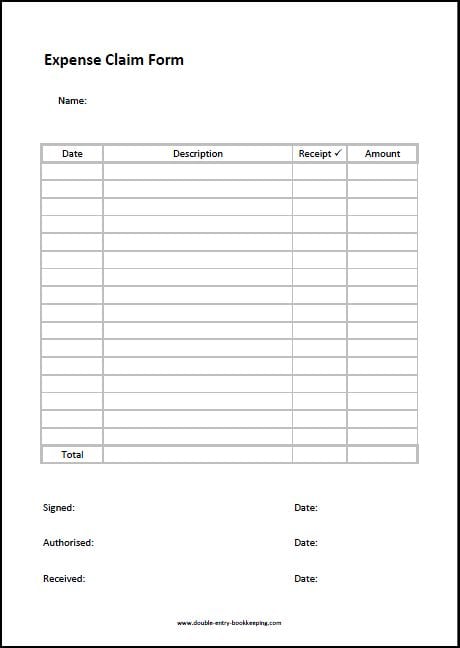

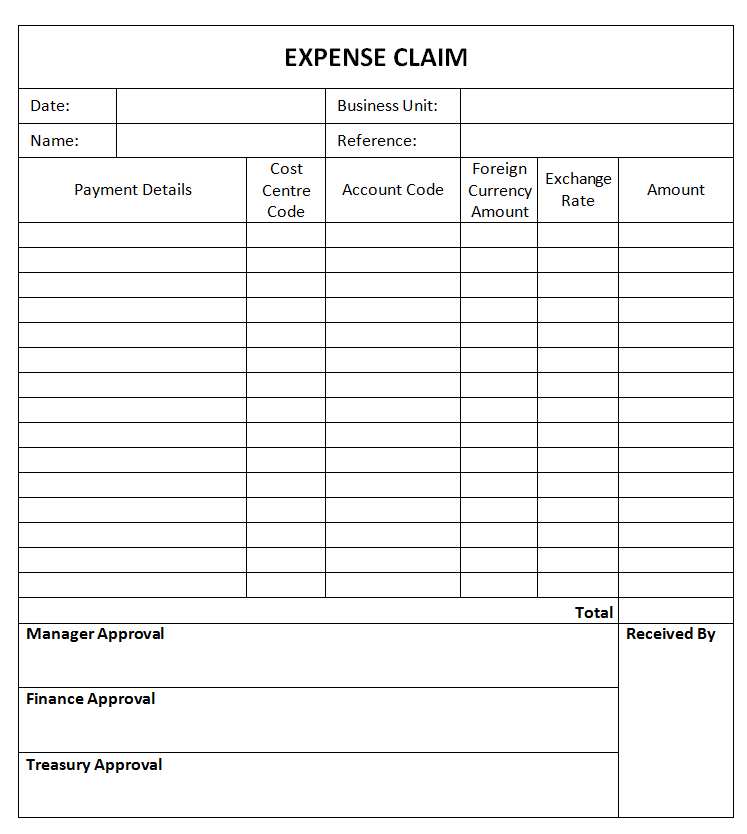

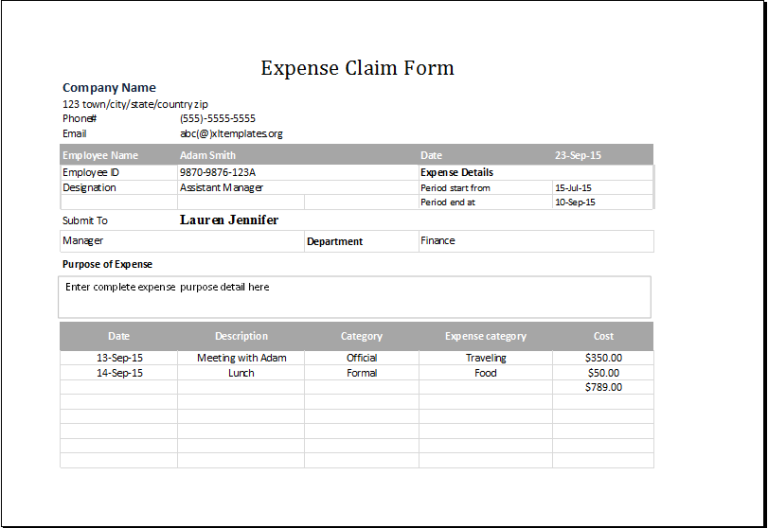

Expense Claim Form Sample

https://www.getexceltemplates.com/wp-content/uploads/2016/03/expense-claim-form-template-1452.jpg

Siddharth Agarwal Principal Program Manager Bharti Airtel Ltd

https://cdn-images.himalayas.app/e3z7vpa7hsssilrxggsqupktp5p6

https://www.getcoconut.com › work-from-home-allowance-calculator

As a sole trader working from home you can claim back part of the expenses associated with having a home office to reduce your tax bill HMRC refers to this as the use home as office allowance This calculator will help you figure out how much you can reasonably claim

https://www.1stformations.co.uk › blog › working-from...

Allowable expenses are essential business costs that self employed individuals and employees can claim even when working from home You can claim working from home tax deductions on various costs such as rent or mortgage payments and utility bills

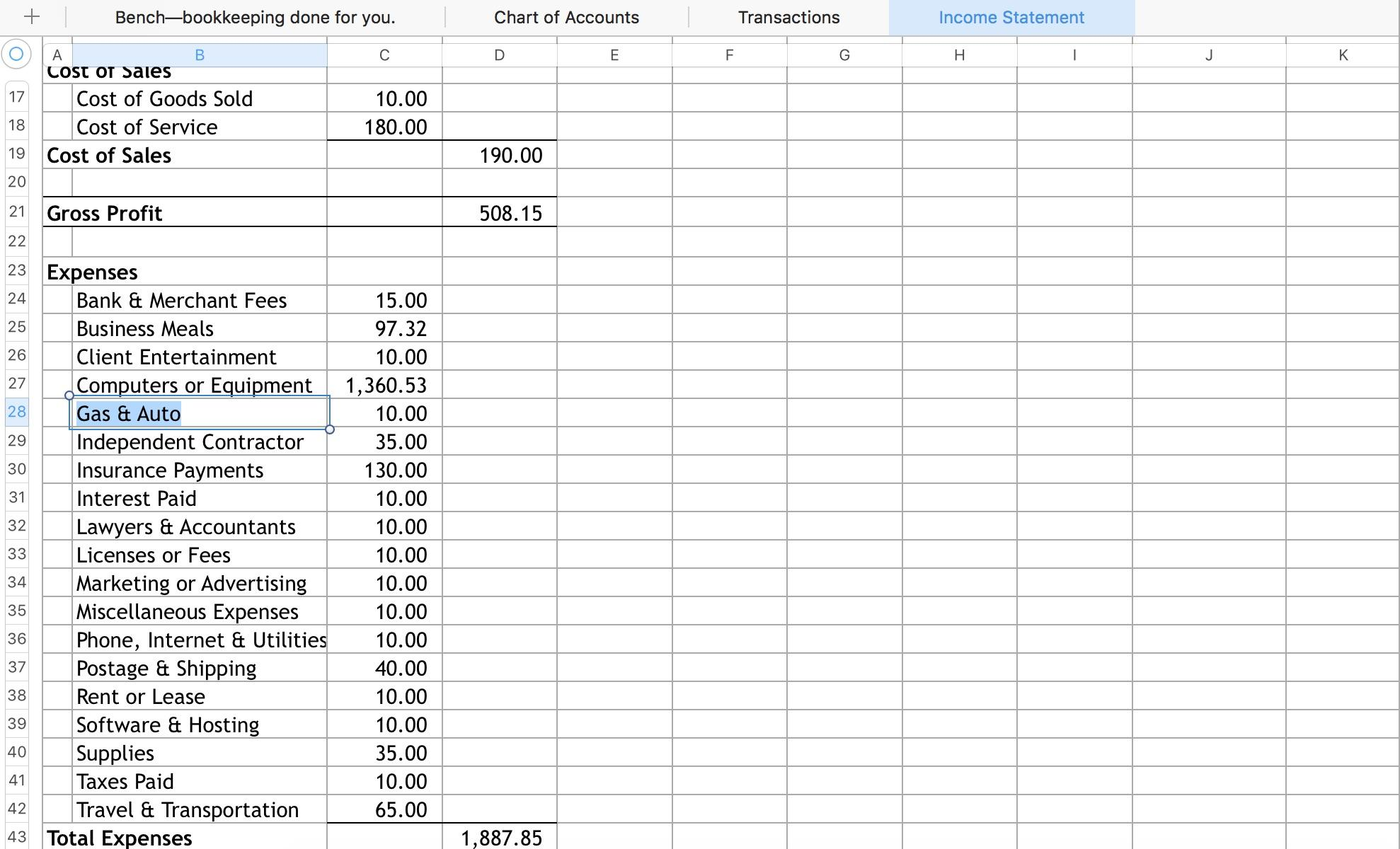

Accounting Templates For Excel

Expense Claim Form Sample

Gifts For Working From Home Satechi Apple And PC Electronic Accessories

Best Laptop 2024 Techradar 2024 Naomi Madelle

Expenses Claim Form Template

Skate Canada Next Gen Team 2024 Dates Talya Elisabeth

Skate Canada Next Gen Team 2024 Dates Talya Elisabeth

Investment Projection Spreadsheet Spreadsheet Downloa Investment

Expense Claim Form Template For EXCEL Excel Templates

Claim Evidence Reasoning Science Examples

How Much Expenses Can I Claim For Working From Home - Worked from home during the Covid 19 pandemic You ve got just days left to claim up to 140 in tax relief Martin Lewis MSE News takes you through the process step by step