Is A 401k Considered A Qualified Plan Employer contributions A key advantage of 401 k s is that your employer may also contribute to help you save for retirement This typically comes in the form of a 401 k

Roth 401 k s When 401 k plans were first rolled out in the 1980s companies and their employees had one choice the traditional 401 k Roth 401 k s didn t arrive until 2006 A 401 k is an employer sponsored retirement plan that comes with tax benefits Basically you put money into the 401 k where it can be invested and potentially grow tax free

Is A 401k Considered A Qualified Plan

Is A 401k Considered A Qualified Plan

https://www.solo401k.com/wp-content/uploads/Screen-Shot-2023-01-11-at-2.58.47-PM-1024x709.png

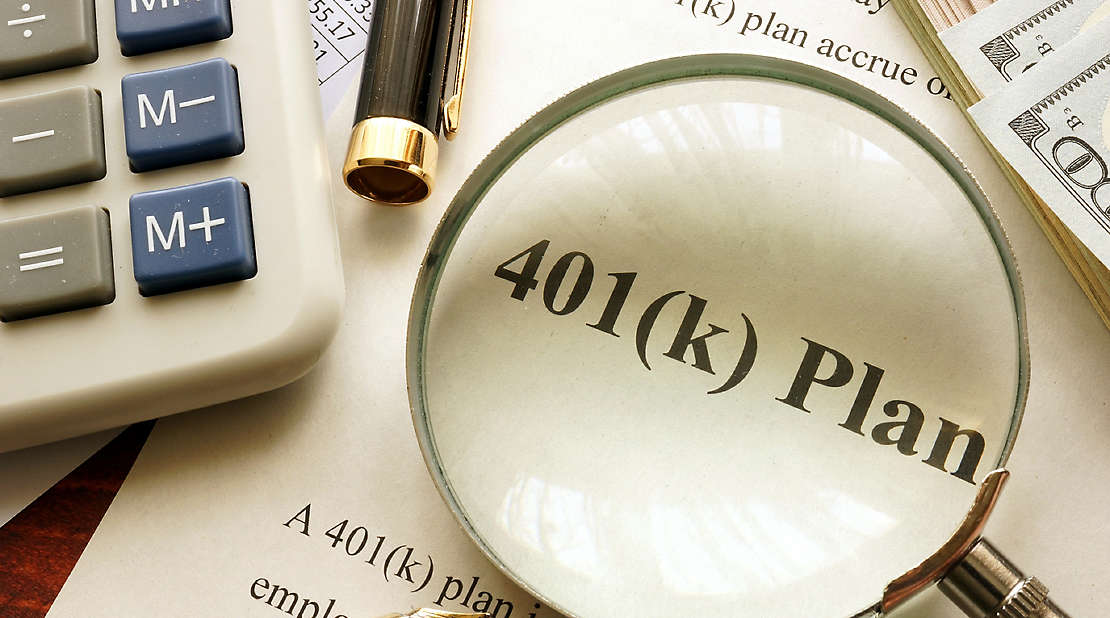

What Is 401K IRA Vs 401K Retirement Answers From Napkin Finance

https://napkinfinance.com/wp-content/uploads/2019/01/NapkinFinance-IRAvs401k-Napkin-08-16-20-v06.jpg

401k Contribution Max 2025 Maverick Brooks

https://www.investors.com/wp-content/uploads/2019/12/wFAP-contribution-122719.jpg

1 U S Bureau of Labor Statistics 73 percent of civilian workers had access to retirement benefits in 2023 September 2023 2 IRS 401 k Plan Qualification Contribution Type Contribution Limit 2025 Employee contributions 23 500 Catch up contribution employees 50 or older 7 500 SIMPLE 401 k contributions

Should I Move 401k to Bonds Should You Keep Investing in Your 401 k Plan Should You Put Your 401 k Into an Annuity Understanding and Maximizing Your Roth 401 k A 401 k is a staple for many people s retirement planning so it s important to understand how they work Browse Investopedia s expert written library to learn more

More picture related to Is A 401k Considered A Qualified Plan

401k Performance 2025 Fawne Chelsae

https://learn.financestrategists.com/wp-content/uploads/Traditional_401k_Plan.png

:max_bytes(150000):strip_icc()/Roth-401K-Final-1ed01a8c82d14465846c533ab2e0eed2.jpg)

Roth 401k Max 2024 Tobe Adriena

https://www.investopedia.com/thmb/dzzQdGpstuZF0WNwboZxSGJMrT0=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Roth-401K-Final-1ed01a8c82d14465846c533ab2e0eed2.jpg

Qualified Retirement Plan What Is It Types Examples

https://www.wallstreetmojo.com/wp-content/uploads/2022/11/Qualified-Retirement-Plan.png.webp

A 401 k plan is an investment account offered by your employer that allows you to save for retirement If your company offers a 401 k plan it may have certain eligibility requirements A complete guide to 401 k retirement plans What is a 401 k Bankrate June 02 2025 https www bankrate retirement 401k

[desc-10] [desc-11]

Irs Annual Gift Limit 2025 Karim Addox

https://meldfinancial.com/wp-content/uploads/2023-11-16-2024-past-401k-limits.png

401k Contribution Limits 2025 Company Match Felix Lawson

https://slavic401k.com/wp-content/uploads/2022/02/Employer-Matching-Table.png

https://www.fidelity.com › learning-center › smart-money

Employer contributions A key advantage of 401 k s is that your employer may also contribute to help you save for retirement This typically comes in the form of a 401 k

https://www.investopedia.com › terms

Roth 401 k s When 401 k plans were first rolled out in the 1980s companies and their employees had one choice the traditional 401 k Roth 401 k s didn t arrive until 2006

2025 401 K Limits Over 50 Faris Nolan

Irs Annual Gift Limit 2025 Karim Addox

Limit Qualified Ira Amount Tax Year 2025 Jennifer Grants

401 k Vs Pension Plan How Each Plan Affects Your Retirement

Sep Ira Contribution Limits 2025 Over 50 Jasper Vaugn

New 401 k Factors To Consider In 2022

New 401 k Factors To Consider In 2022

401 k Plan Definition How It Works Types Features

Can I Have A Roth IRA And A 401K Investment Finance News

What Is 401k Max For 2025 Larry Song

Is A 401k Considered A Qualified Plan - [desc-13]