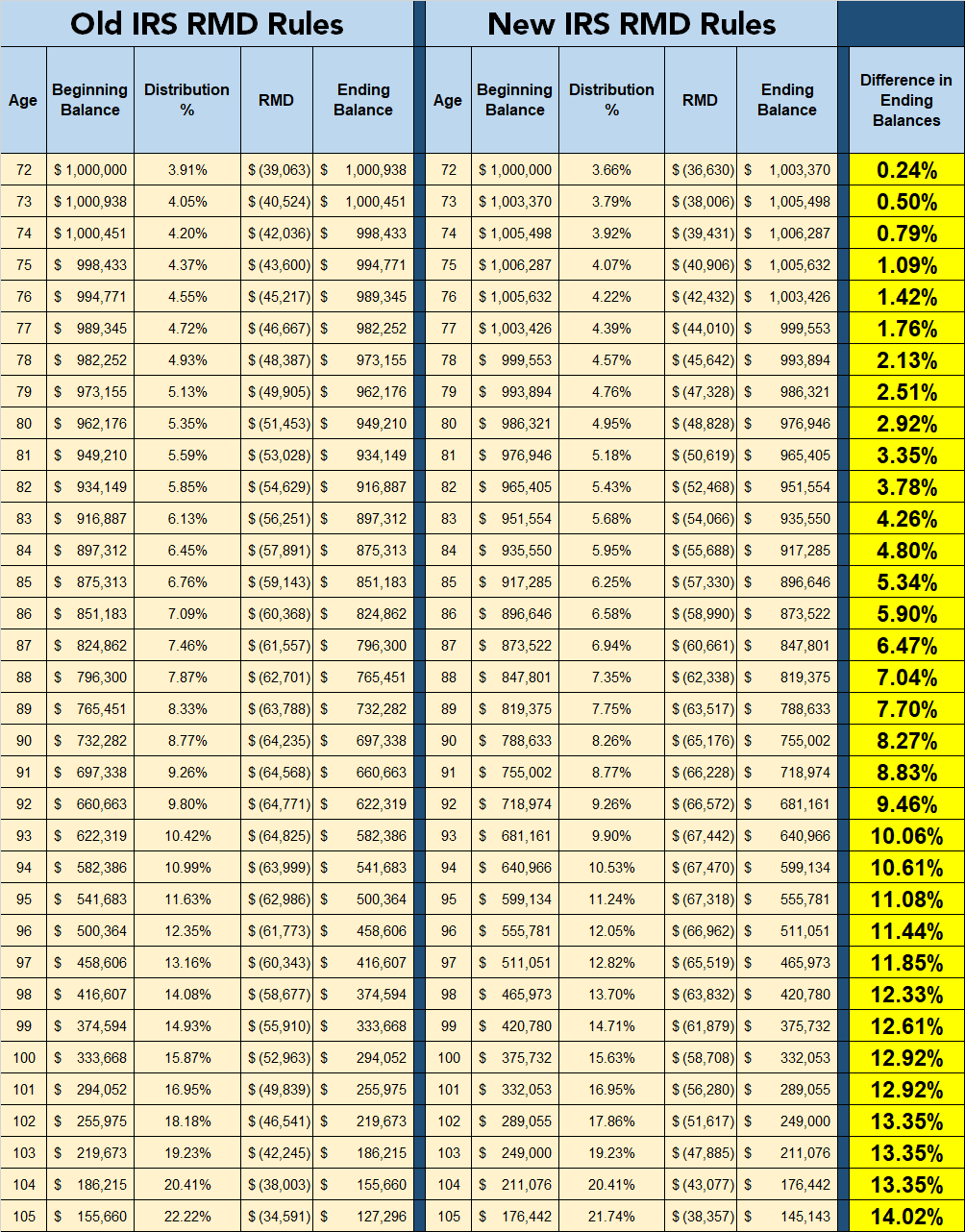

Rmd For 10 Year Rule The purpose of the RMD rules is to ensure that people do not accumulate retirement accounts defer taxation and leave these retirement funds as an inheritance Instead required minimum

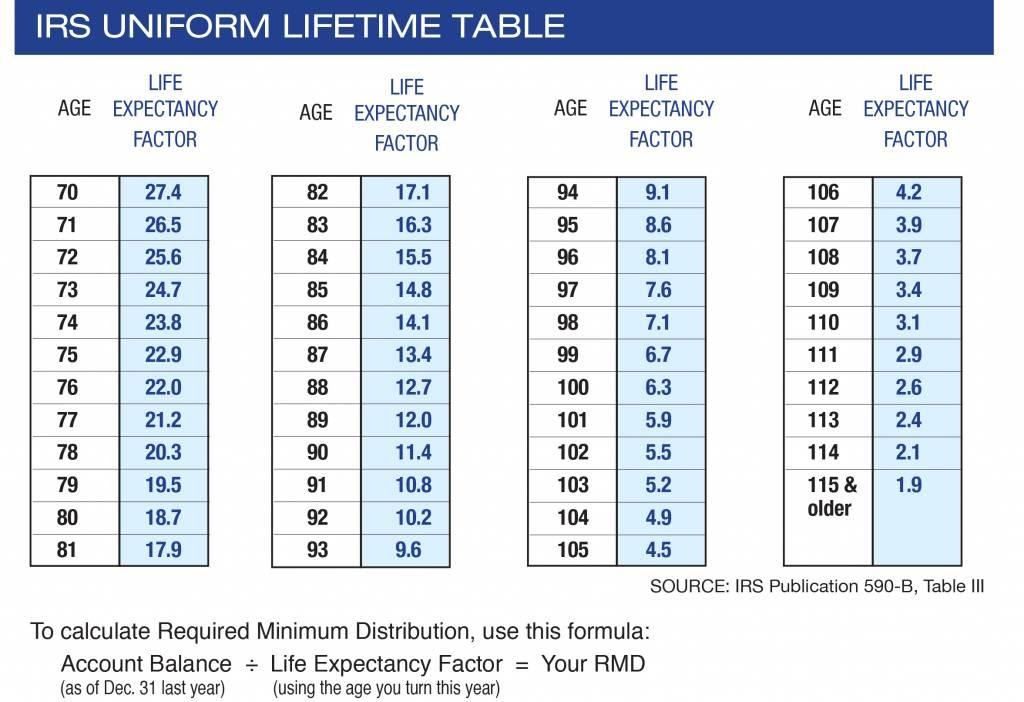

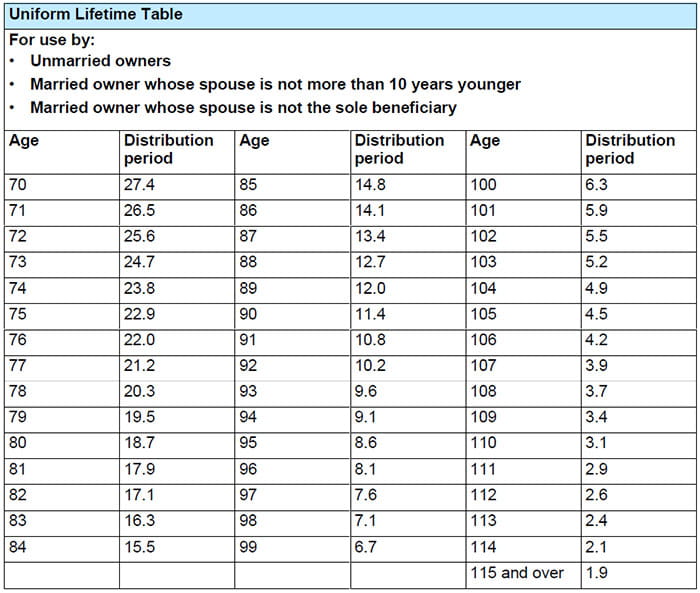

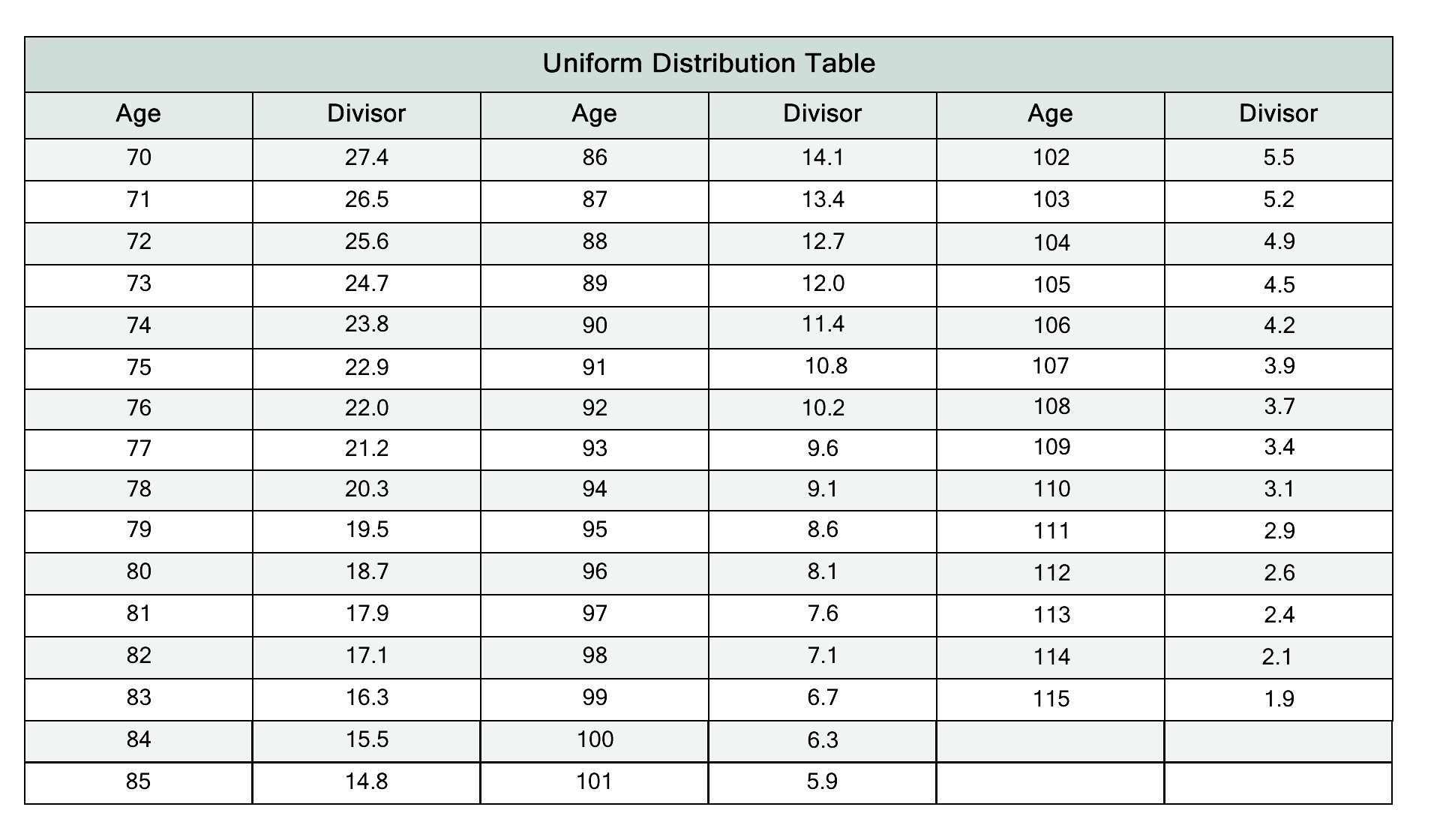

A required minimum distribution RMD is the amount of money that must be withdrawn annually from certain employer sponsored retirement plans like 401 k s and certain A required minimum distribution or RMD is the amount of money that the IRS requires you to withdraw annually from certain retirement plans the year after you turn 73

Rmd For 10 Year Rule

Rmd For 10 Year Rule

https://i.ytimg.com/vi/v5a2OguyI3E/maxresdefault.jpg

Uniform Lifetime Table Cabinets Matttroy

https://images.ctfassets.net/94t4bn80wfcg/6nxEyaQckj05i5yYy6FcB5/0f9d0c7ec2823b1caeb790379532de30/IRS_uniform_lifetime.jpg

Aarp Rmd Calculator 2025 Fawne Christal

https://www.raymondjames.com/-/media/rj/advisor-sites/sites/n/e/nevadafamilywealth/images/rmd-chart.jpg

Cookies Mums r pi J s privatumas Siekdami sukurti Jums patogi aplink ioje svetain je statistikos ir rinkodaros tikslais naudojame slapukus angl cookies UAB Rmd Technologies Uab Rmd Technologies 302463683 Lietuvos moni katalogas Imones PVM adresas telefonas pelnas darbuotojai skolos em lapis Konsultacin verslo ir kito

An RMD is the amount of money that you must withdraw from nearly all types of tax deferred retirement accounts each year once you hit a certain age What is an RMD A required minimum distribution RMD is the amount the government requires you to withdraw each year from certain retirement accounts such as a 401 k or IRA once

More picture related to Rmd For 10 Year Rule

Aarp Rmd Calculator 2025 Fawne Christal

https://alquilercastilloshinchables.info/wp-content/uploads/2020/05/RMD-Table-Required-Minimum-Distribution.jpg

2024 Rmd Changes Jodie Lynnett

https://levelfa.com/wp-content/uploads/2020/12/RMD-Rule-Changes.png

2024 Rmd Age Table

https://bestpathforward.com/wp-content/uploads/2023/06/RMD-chart.png

RMD rules dictate the minimum amount you must withdraw from your account every year beginning at age 73 depending on your age on Jan 1 2023 It is important to have a good grasp of required minimum distribution RMD rules and the tax implications that come with them That can help you manage your tax obligations

[desc-10] [desc-11]

What Is A Donee Beneficiary

https://www.kitces.com/wp-content/uploads/2020/07/Graphic-2-Successor-Beneficiaries-Inherit-Assets-From-The-Beneficiaries-Of-Original-Account-Owners.png

Heslo Farba Previs Str nky Past Life Calculator Prvok Prekvapivo Vyhl si

https://cdn.mos.cms.futurecdn.net/CHywFzjrJvzaXM2tybFeDC.jpg

https://en.wikipedia.org › wiki › Required_minimum_distribution

The purpose of the RMD rules is to ensure that people do not accumulate retirement accounts defer taxation and leave these retirement funds as an inheritance Instead required minimum

https://www.investopedia.com › terms › required...

A required minimum distribution RMD is the amount of money that must be withdrawn annually from certain employer sponsored retirement plans like 401 k s and certain

Rmd Calculator 2025 Aarp Medicare Otis G Hawkins

What Is A Donee Beneficiary

Rmd Table 2025 Pdf Free Windy Lilian

Rmd Table 2025 Pdf 2025 Nani Michaela

Rmd Tax Factors For 2025 Carey Maurita

Rmd Tax Factors For 2025 Carey Maurita

Rmd Tax Factors For 2025 Carey Maurita

Current Life Expectancy 2025 Lok Abdul Reyna

Aarp Rmd Calculator 2025 Table Reta Rosemarie

TSP Calculator Estimate Thrift Savings Plan Withdrawals In Retirement

Rmd For 10 Year Rule - [desc-13]