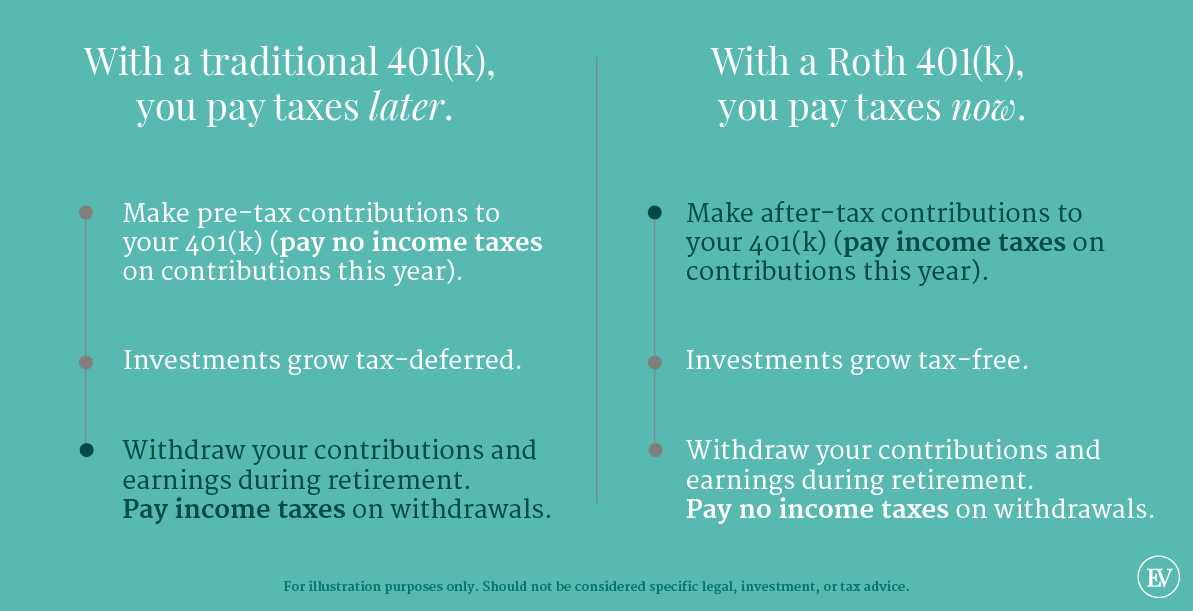

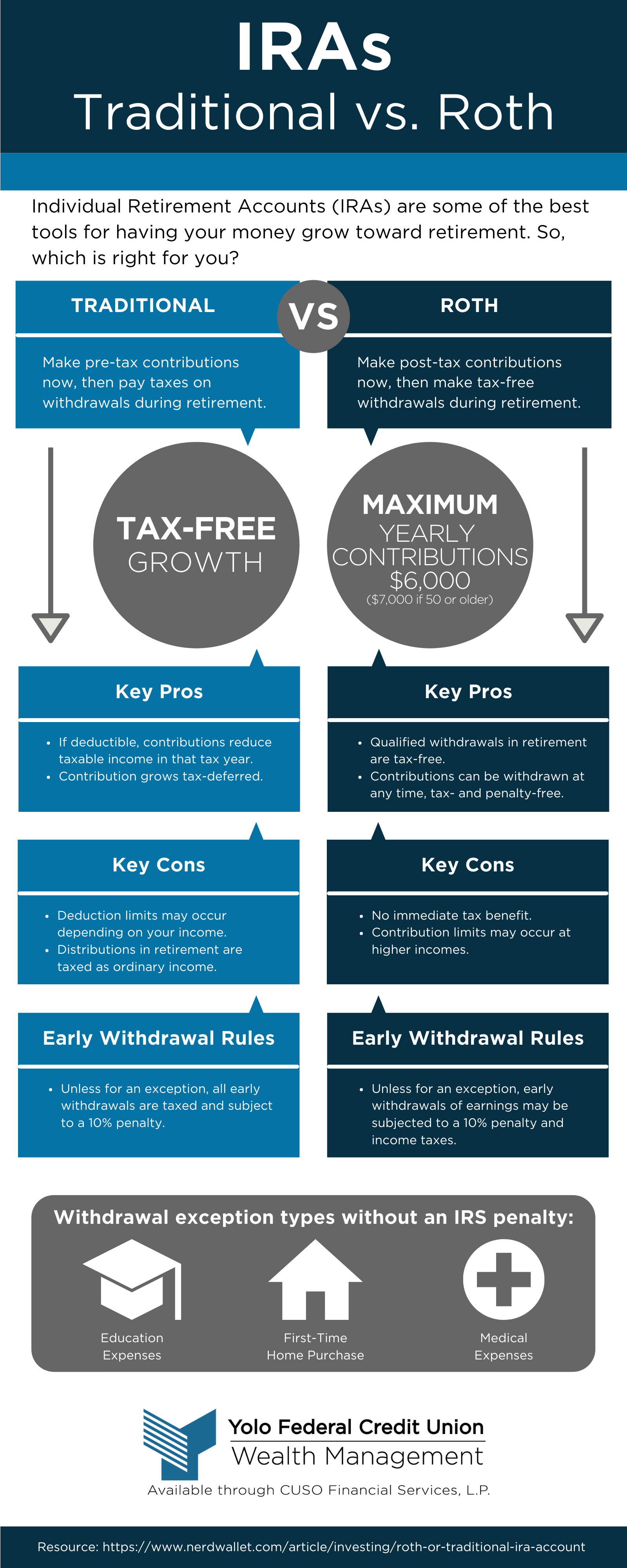

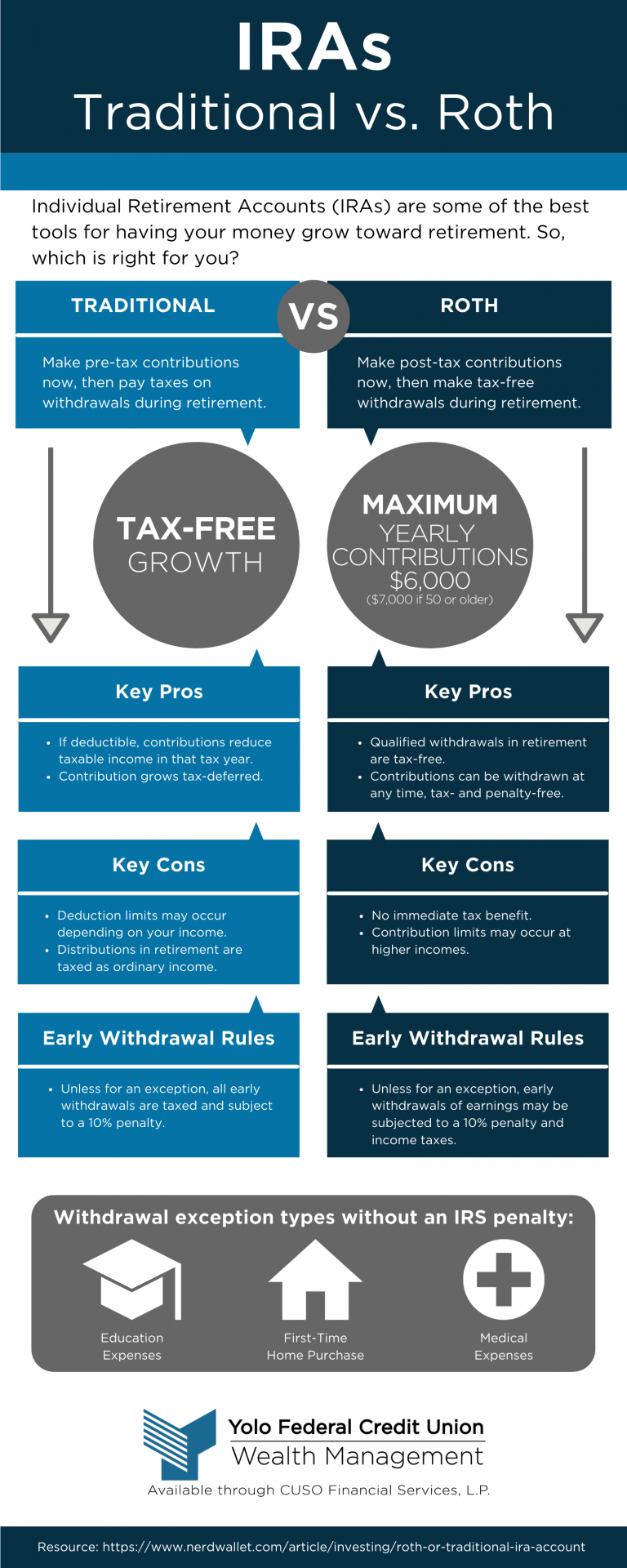

When Can I Convert Roth 401k To Roth Ira You should be able to roll over your 401 k into a Roth IRA but be prepared to pay taxes when you make the transition When you withdraw funds they won t be taxed

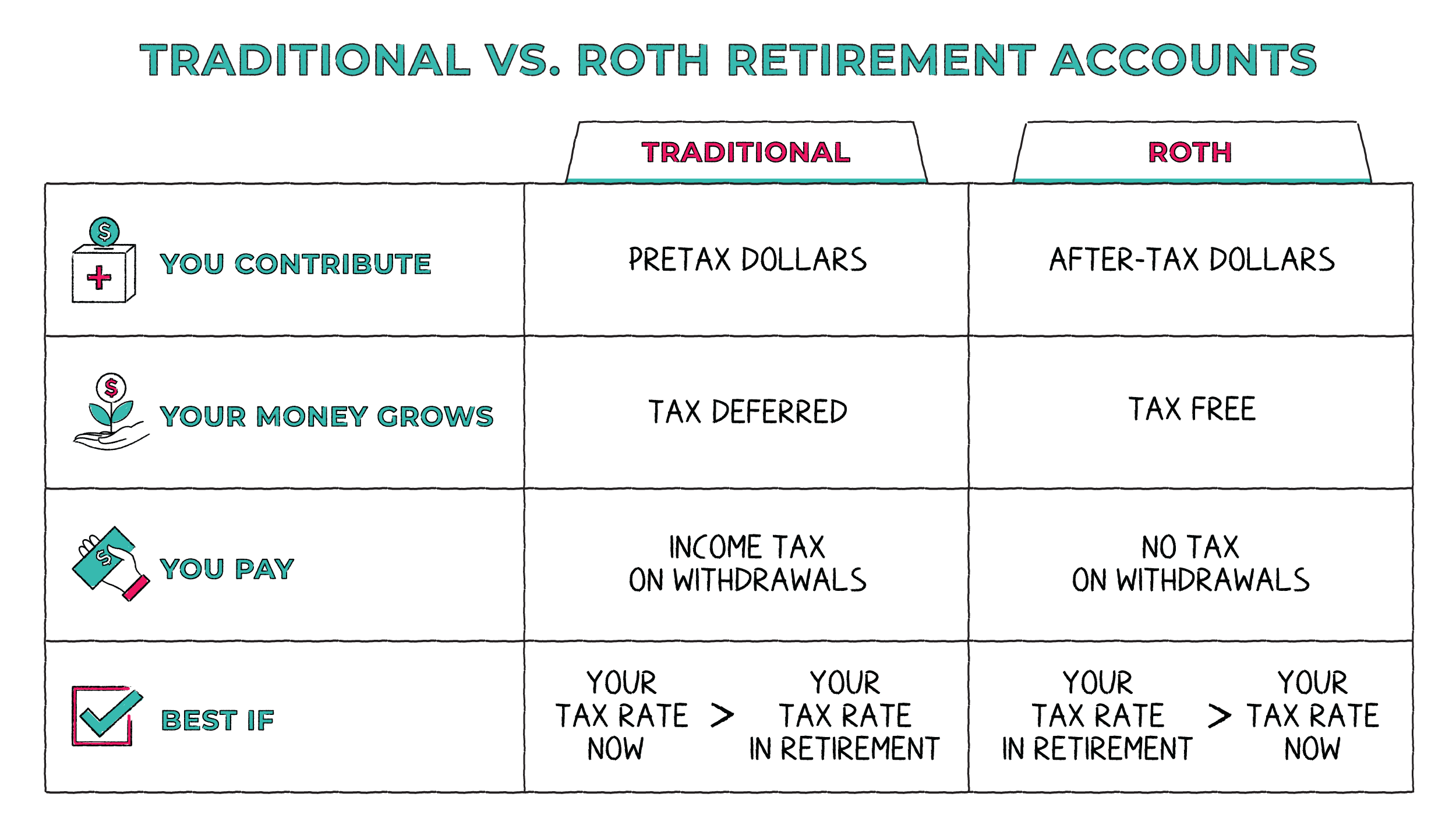

Selling investments Most traditional IRA investments can convert to a Roth IRA without being sold Most 401 k s convert in cash Value of the conversion You ll receive the closing market You can convert your traditional 401 k either through a direct rollover to a Roth IRA or by rolling funds over to a traditional IRA and then converting to a Roth IRA Tip For more

When Can I Convert Roth 401k To Roth Ira

When Can I Convert Roth 401k To Roth Ira

https://www.theskimm.com/_next/image?url=https:%2F%2Fimages.ctfassets.net%2F6g4gfm8wk7b6%2F6C2dwsIzDhqx0ZlHlJbPdm%2F8bfbea89445676b07e35a62db8c3c548%2FRoth_401k.png&w=1080&q=75

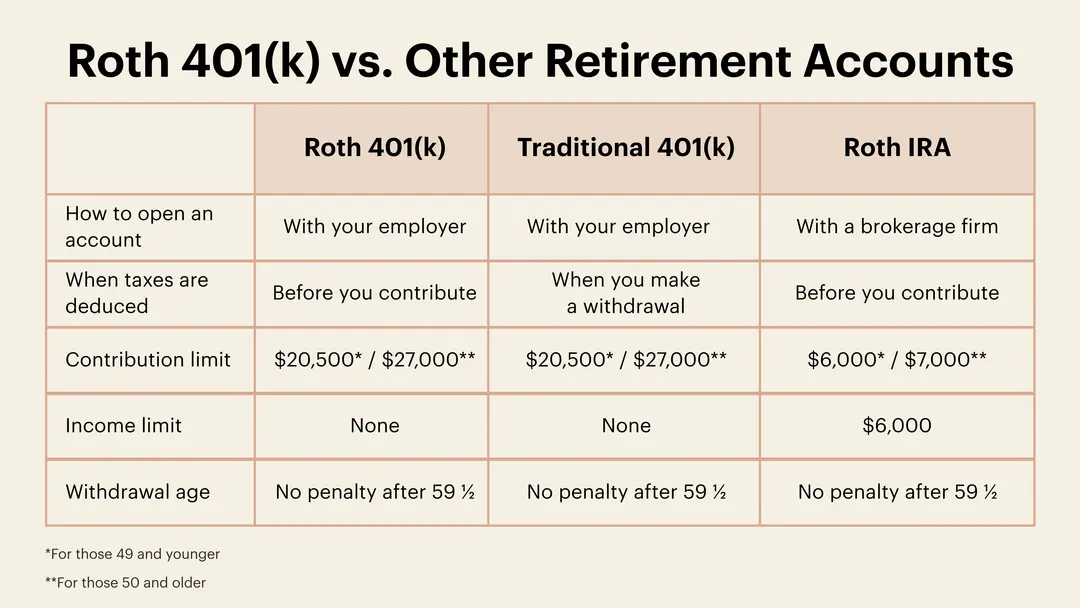

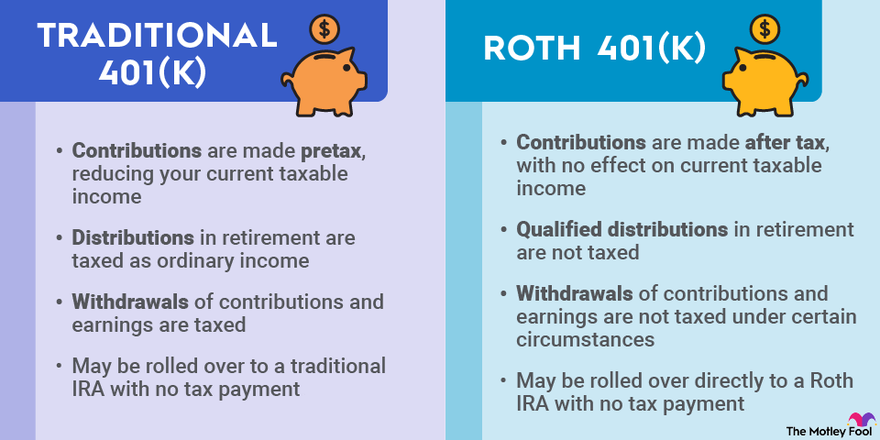

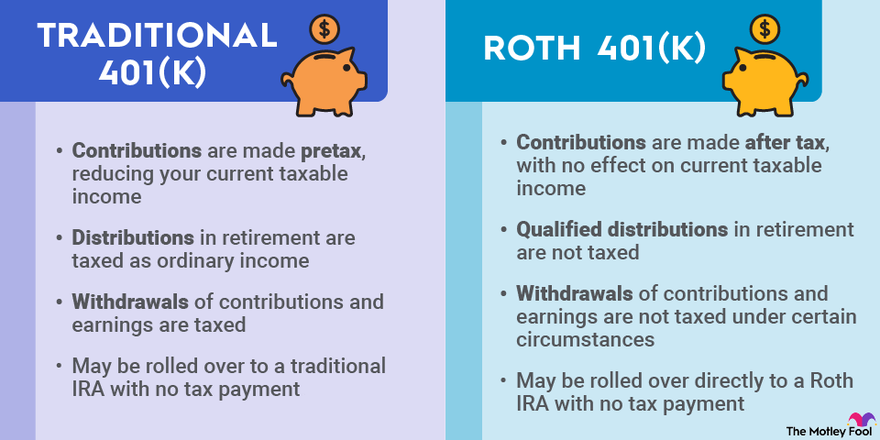

Roth 401 K

https://napkinfinance.com/wp-content/uploads/2019/01/NapkinFinance-IRAvs401k-Chart-07-31-20-v02.png

Roth 401 K

https://images.ctfassets.net/mgl1kxuxn1e1/3InbjxiZX2UGyyGc42QA6e/2742f98dad38b0cc1cd520f69c4f296f/TraditionalvsRoth401kExplainer.png

A partial conversion allows you to convert only a portion of your 401 k to a Roth IRA offering greater control over the tax impact This approach lets you spread the tax liability It s best to move the money into an existing Roth IRA account if you have one due to a five year rule that governs qualified distributions Moving the transferred funds to another

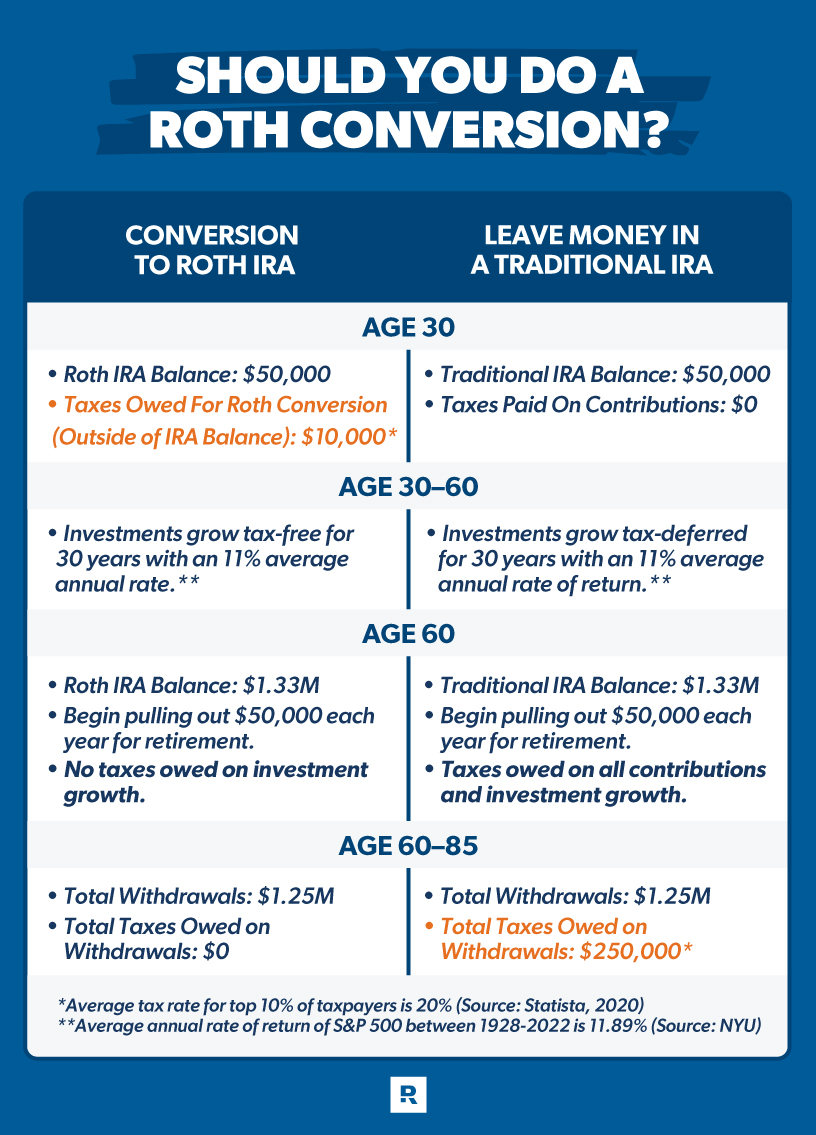

401 k to Roth IRA conversions typically raise your tax bill unless you are rolling over funds from a Roth 401 k A Roth IRA conversion ladder is a popular strategy among Here s a quick look at how to convert to a Roth IRA plus considerations when deciding whether it makes sense for you A Roth individual retirement account allows investors

More picture related to When Can I Convert Roth 401k To Roth Ira

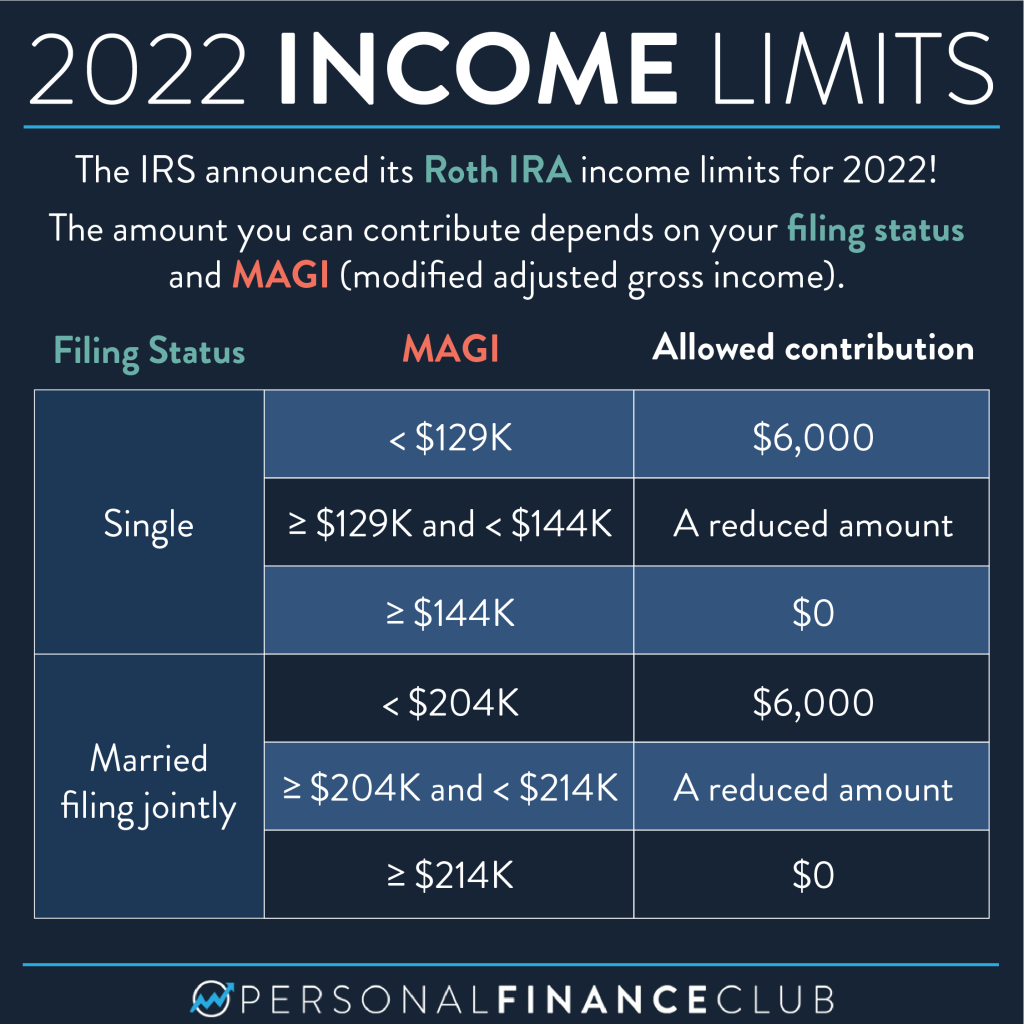

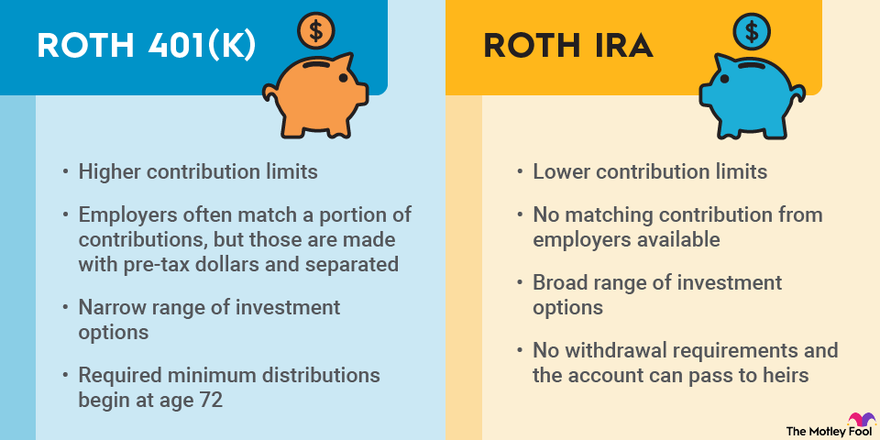

The Ultimate Roth IRA Guide District Capital Management

https://districtcapitalmanagement.com/wp-content/uploads/2022/01/Roth-401k-vs-Roth-IRA.jpg

Irs Fica Limit 2024 Carin Cosetta

https://www.personalfinanceclub.com/wp-content/uploads/2021/11/2021-11-12-2022-Roth-IRA-Income-Limits-1024x1024.png

Roth 401 K

https://m.foolcdn.com/media/dubs/images/roth-401k-vs-roth-ira-retirement-plans-infogra.width-880.png

What s the optimal timing for converting your 401k to a Roth IRA Learn key factors to consider and make informed decisions about maximizing your retirement savings And in some cases you can start with one type of account and change to another for example you can convert a pretax 401 k account to a Roth IRA If you have

When Is Rolling Over Your Roth 401 k To a Roth IRA a Good Idea If you consider leaving a job rolling over a Roth 401 k to a Roth IRA can be a good idea This Yes you can roll over a 401 k to an existing Roth IRA or to a new Roth IRA Can I roll my 401 k into a Roth IRA without penalty You can roll over 401 k to a Roth IRA

Roth 401k Rollover

https://m.foolcdn.com/media/dubs/images/401k-vs-Roth-401k-retirement-plans-infographic.width-880.png

Roth 401k Rollover

https://cdn.ramseysolutions.net/media/blog/retirement/retirement-planning/roth-conversion.jpg

https://www.investopedia.com › articles › retirement

You should be able to roll over your 401 k into a Roth IRA but be prepared to pay taxes when you make the transition When you withdraw funds they won t be taxed

https://www.fidelity.com › retirement-ira › ro

Selling investments Most traditional IRA investments can convert to a Roth IRA without being sold Most 401 k s convert in cash Value of the conversion You ll receive the closing market

Roth 401k Rollover

Roth 401k Rollover

Max Amount For Roth Ira 2024 Carri Cristin

Roth Contribution Limits 2025 Income Hana Jamie

Traditional Ira Income Limits 2025 Married Luna Faith

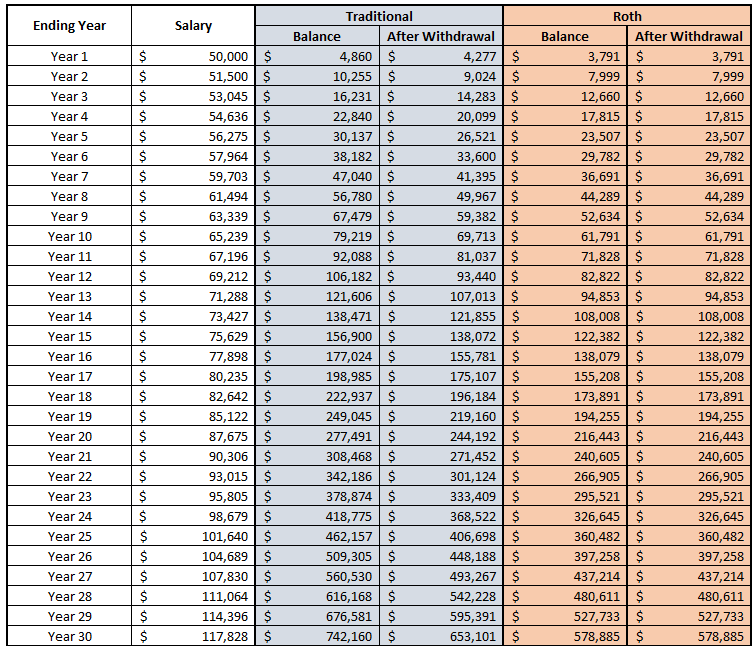

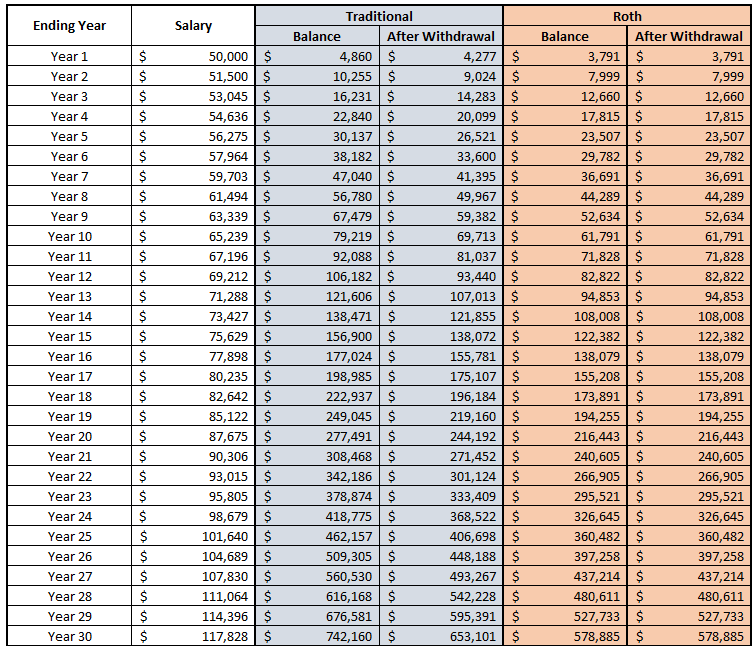

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Traditional Ira Income Limits 2024 Alice Wrennie

2022 Ira Contribution Limits Over 50 EE2022

401k 2025 Grace Barber

When Can I Convert Roth 401k To Roth Ira - Rolling over after tax money to a Roth IRA If you have after tax money in your traditional 401 k 403 b or other workplace retirement savings account you can roll over the