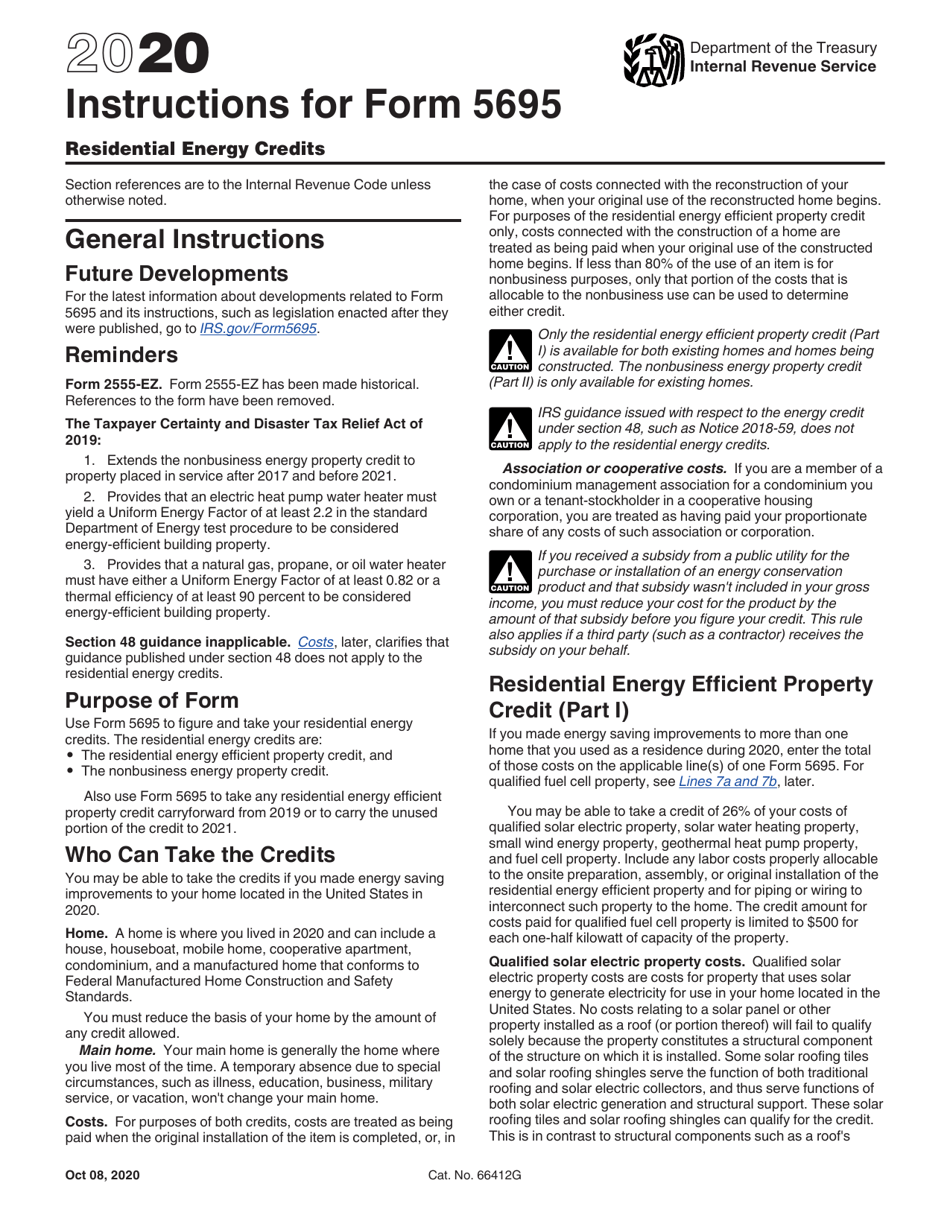

What Is The Maximum Residential Energy Credit Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023

You can claim the maximum annual credit every year that you make eligible improvements or install energy efficient property until 2033 However beginning in 2025 for each item of qualifying property placed in service no credit will be allowed unless the item was produced by a qualified manufacturer and the taxpayer reports the PIN for the In general the residential clean energy property credit is a 30 credit for certain qualified expenditures made by a taxpayer for residential energy efficient property during a year The credit rate of 30 now applies to property placed in

What Is The Maximum Residential Energy Credit

What Is The Maximum Residential Energy Credit

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=1368949807243185

YouTube Videos Archive JERRY And LINDA

https://jerryandlinda.com/wp-content/uploads/2023/10/jerrynlinda.jpg

Common Questions About IVF What Is The Maximum Age For IVF

https://goodivf.us/wp-content/uploads/2023/07/3-1.jpg

Then there is an entirely different credit called the Residential Clean Energy Credit This includes solar electric solar water heating fuel cell small wind energy geothermal and battery storage The credit is 30 with no maximum except fuel cells 500 per half kilowatt and you can claim the credit in any year you install qualifying This means you can claim a maximum total yearly energy efficient home improvement credit amount up to 3 200 Residential Clean Energy Credit The Residential Clean Energy RCE Credit is a renewable energy tax credit extended and expanded by the 2022 Inflation Reduction Act

The maximum annual tax credit for energy efficient home improvements is 3 200 This includes up to 1 200 for certain improvements e g central air conditioners furnaces and up to 2 000 for others e g heat pumps biomass stoves The Residential Energy Efficient Property Credit also known as the Residential Clean Energy Credit is a tax credit that the U S Federal Government provides to homeowners who install energy efficient upgrades to their homes

More picture related to What Is The Maximum Residential Energy Credit

Int Max In Python Maximum Integer Size

https://cdn.hashnode.com/res/hashnode/image/upload/v1709153015297/mkI7rPRBU.jpg

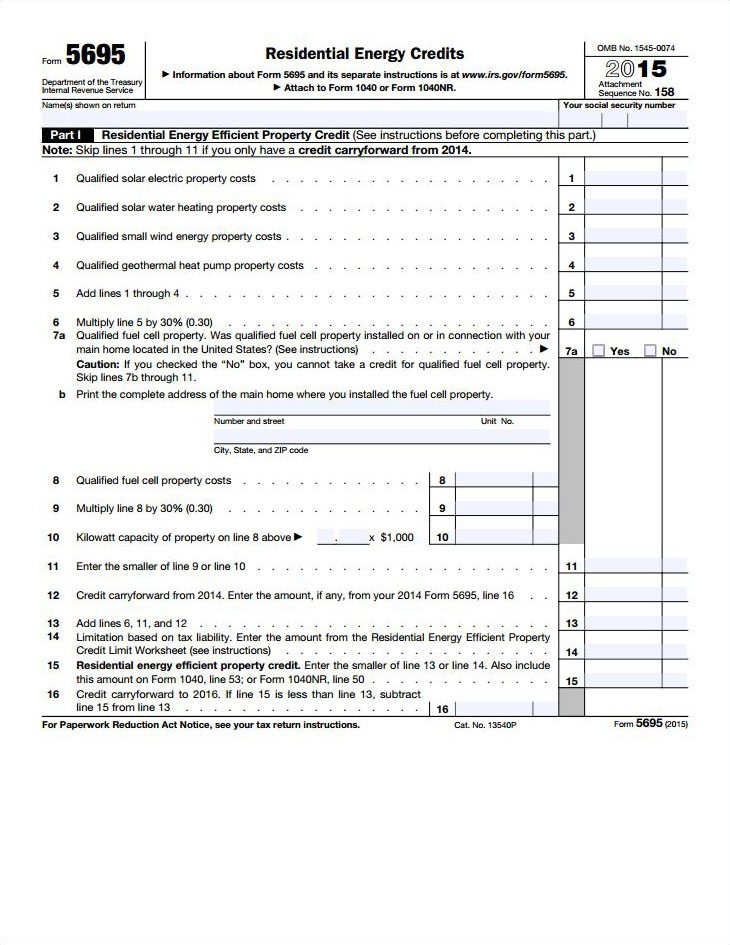

Residential Energy Credit Insulation Supply

https://insulation.supply/wp-content/uploads/2016/01/Insulation-Tax-Credit-IRS-Form-5695.jpg

2025 Tax Credits For Eva Lydia Hope

https://www.teachmepersonalfinance.com/wp-content/uploads/2023/03/irs_form_5695_featured_image.png

The maximum energy efficient home improvement credit is 3 200 a combination of 1 200 for home improvements and 2 000 for heat pumps and biomass stoves or boilers You can only claim How much can you claim under the Energy Efficient Home Improvement Credit Unlike the Residential Clean Energy Property Credit this home energy tax credit does have annual limits The maximum annual credits you can claim are 1 200 for energy property costs and certain energy efficient home improvements

[desc-10] [desc-11]

Home Energy Credits 2025 Lanni Modesta

https://www.armaninollp.com/-/media/images/articles/energy-tax-credits-infographic.jpg

Does A New Roof Qualify For Residential Energy Credit

https://er55hxiqhrv.exactdn.com/wp-content/uploads/2023/08/featured-47.jpg

https://www.irs.gov › credits-deductions › home-energy-tax-credits

Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023

https://www.irs.gov › credits-deductions › energy...

You can claim the maximum annual credit every year that you make eligible improvements or install energy efficient property until 2033 However beginning in 2025 for each item of qualifying property placed in service no credit will be allowed unless the item was produced by a qualified manufacturer and the taxpayer reports the PIN for the

Energy Credits 2024 Cary Marthe

Home Energy Credits 2025 Lanni Modesta

How To Make Employment Contract In Qatar Template 2024

Residential Energy Credit Application 2025 ElectricRate

Irs 2024 Energy Credits Golda Kandace

IRS Form 5695 Residential Energy Credits Forms Docs 2023

IRS Form 5695 Residential Energy Credits Forms Docs 2023

2024 Tax Credits For Energy Efficient Windows Pat Layney

Download Instructions For IRS Form 5695 Residential Energy Credits PDF

HRA Calculator Calculate Your House Rent Allowance In India

What Is The Maximum Residential Energy Credit - [desc-13]